- Banking

Zeller and Xero: Teaming Up for Bank Feeds

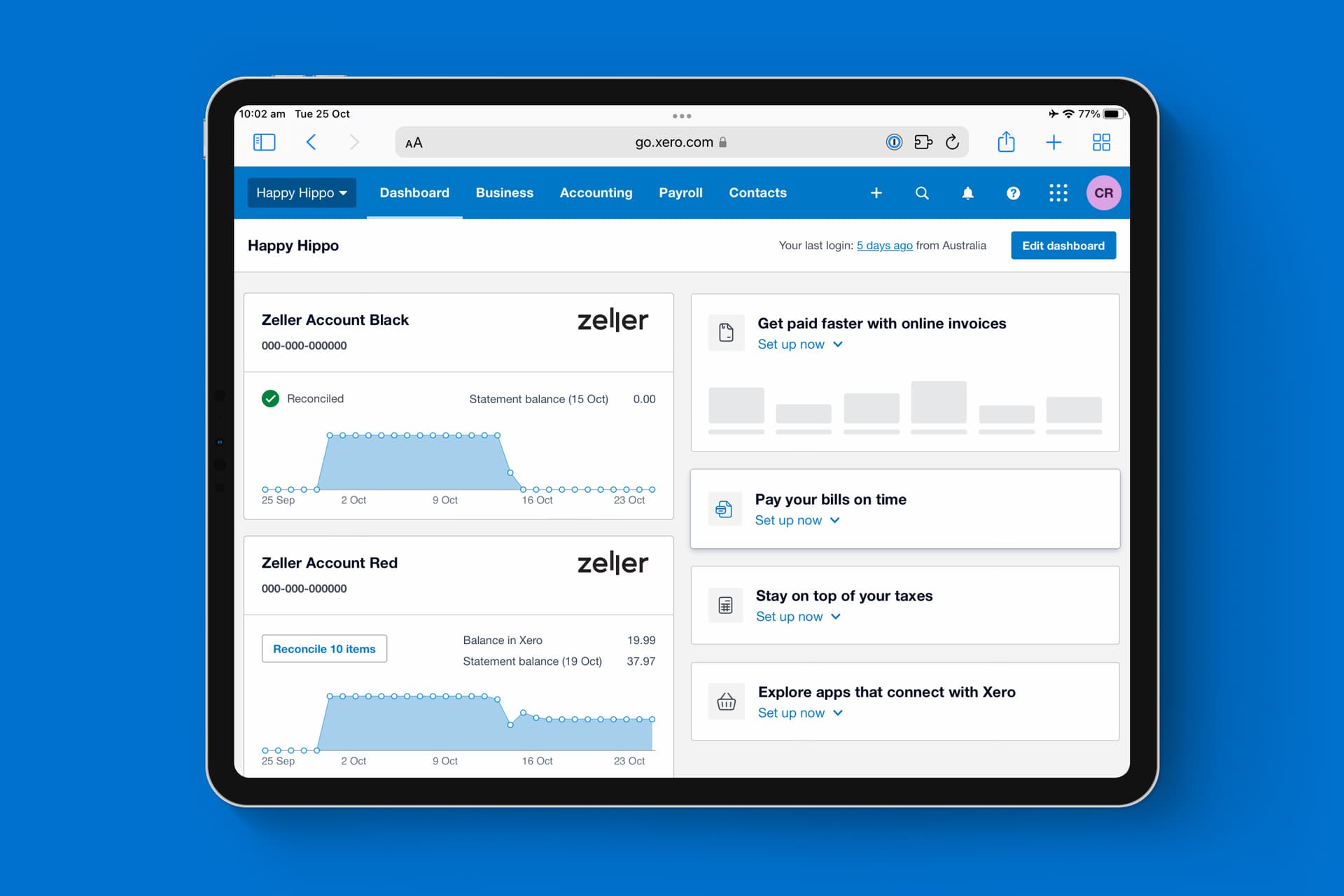

Streamline reconciliation with Zeller's Xero Bank Feeds.

No business owner looks forward to manually reconciling their accounts. We’ve partnered with Xero to reduce the admin load of manual transaction uploads and reconciliations so you can focus on more important tasks.

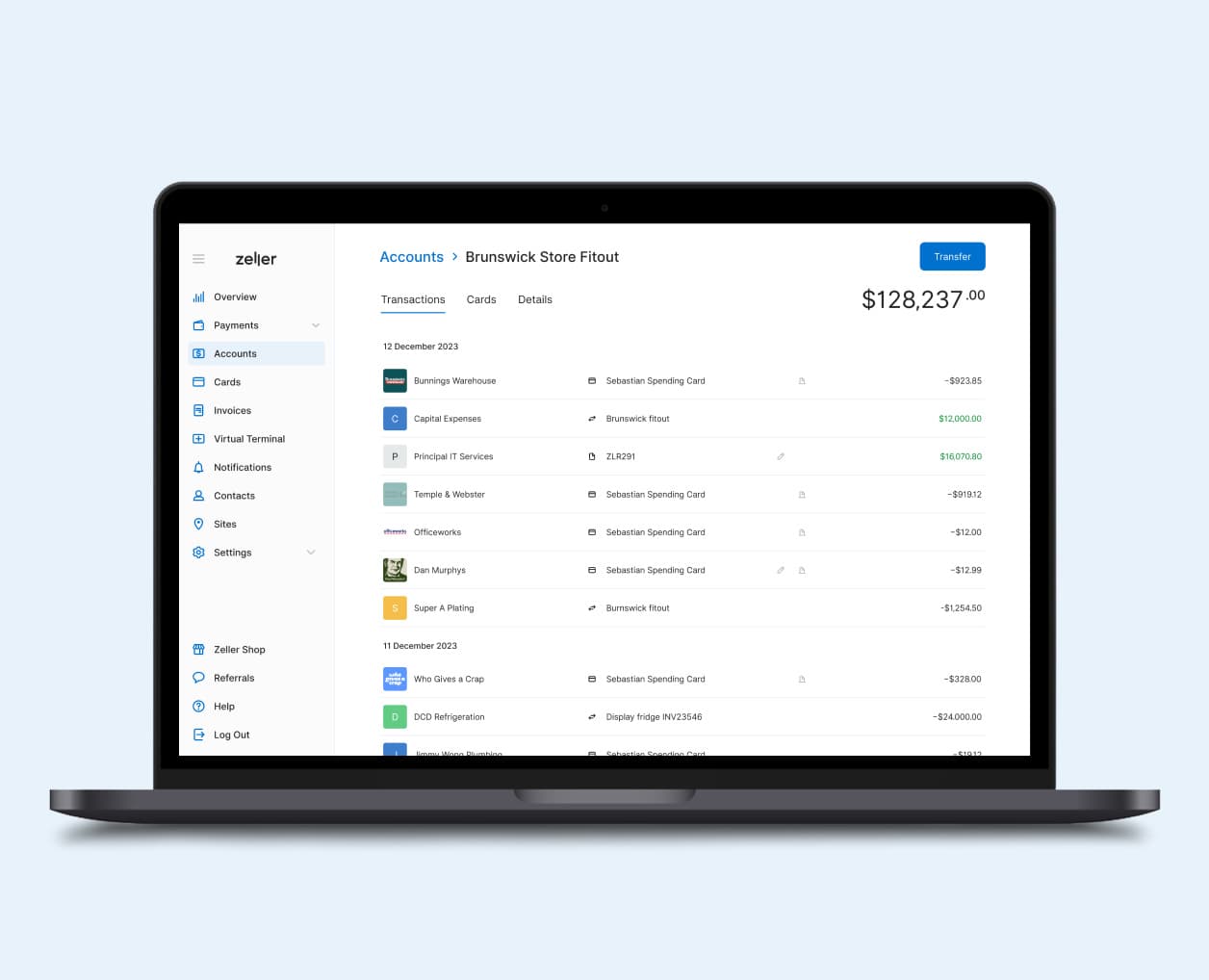

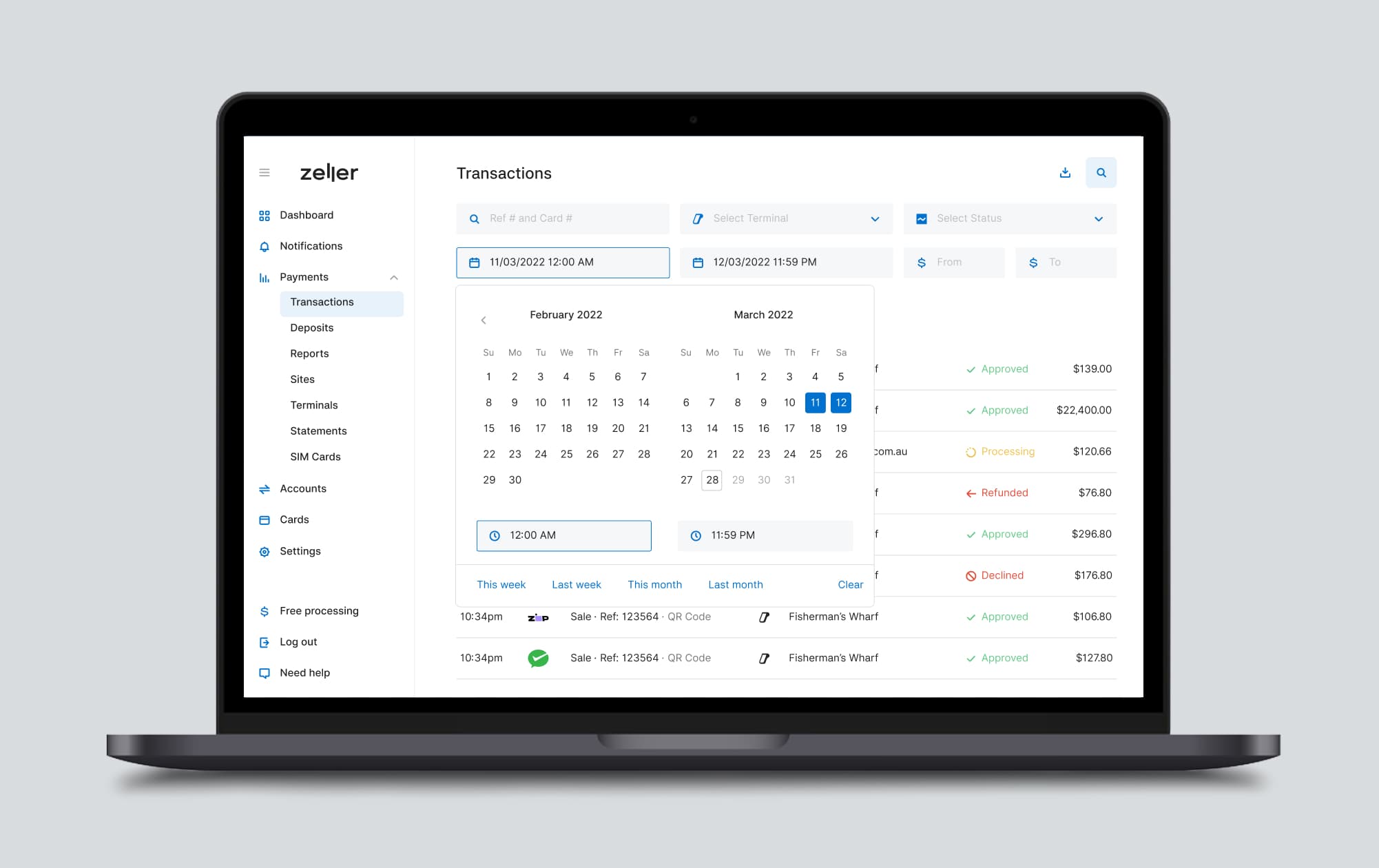

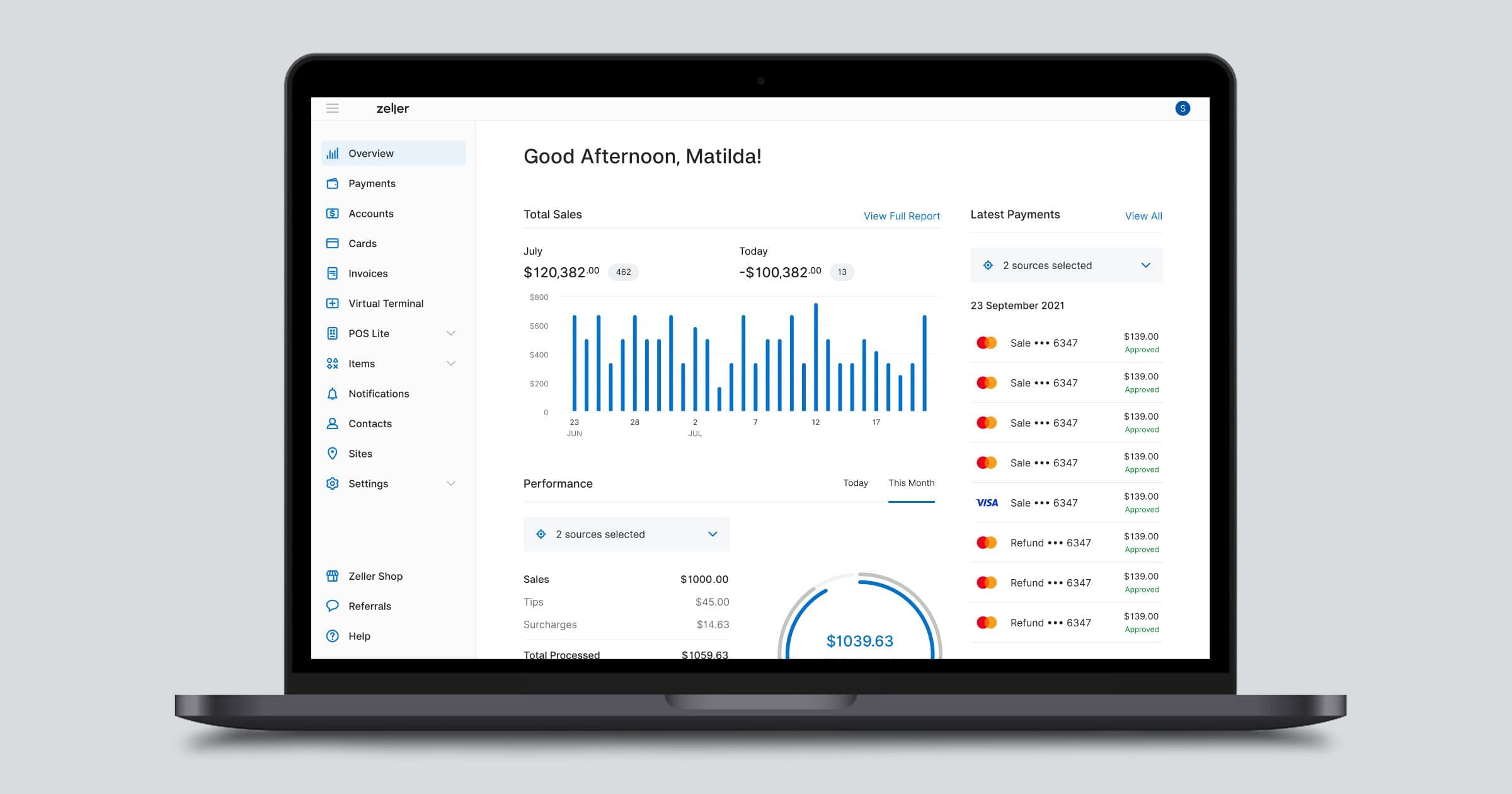

Xero’s online accounting software provides visibility of your business accounts in a simple, smart and secure way. With Xero Bank Feeds, transactions processed through your chosen Zeller Transaction Account are automatically uploaded to your Xero organisation. With Zeller, there’s no need to wait until close of business — an up-to-the-minute feed of your incomings and outgoings will appear in Xero.

This powerful integration helps you to:

simplify your business accounting with an automatic, integrated feed of Zeller transactions to Xero.

save time and run your business more efficiently by eliminating the need to manually import your transactions every day.

securely share accounting information to third parties, without the security risk of sharing your credentials.

understand your cash flow with up-to-the-minute transaction uploads, enabling you to simplify your tax returns, more easily control cash flow and make smarter business decisions.

Connect your Zeller Transaction Account to Xero in just a few clicks today.

What is a bank feed?

A bank feed automatically sends information about transactions to your accounting software.

Together, Zeller works with Xero to automatically import transactions from your Zeller account directly into your Xero organisation. Xero direct bank feeds ensure transactions are accurately reflected across your most-used financial and reporting tools, giving you an up-to-the-minute view of your cash flow at any point in time.

When you use bank feeds, both incoming and outgoing transactions flow seamlessly into Xero — reducing manual admin as well as the risk of data entry errors. You can even grant secure access to third parties, like your accountant or bookkeeper, to help you forecast and plan from the exact same data.

Why set up a bank feed with Xero?

A streamlined payment and reconciliation system allows business owners to see their true financial position at any point in time.

Zeller’s automatic bank feeds help you stay in control of your finances while saving time on manual data entry, by enabling you to keep track of your incomings. All of this arms you with insight you can use to grow your business and makes tax time easier. By giving you the ability to grant secure access to third parties, such as your accountant or bookkeeper, it also streamlines your accounting and reporting tasks.

Ready to get started with Zeller?

Sign up freeSetting up Zeller and Xero bank feeds

Using Zeller’s integrated bank feeds is an easy way to take control of your cash flow, and improve your business. Plus, it’s free to set up.

Before setting up a Xero direct bank feed, you'll need:

a Zeller Account

to be accepting transactions into your Zeller Transaction Account and/or spending using your Zeller Mastercard

to be logged in to Zeller Dashboard

to be registered as a customer with Xero

Connect your bank feeds

Many small business owners already use business accounting software, like Xero. To set up bank feeds:

log in to Zeller Dashboard

navigate to the new Xero Bank Feeds Integration connection by clicking to expand Settings, then clicking Connections

Read and accept the disclaimer

Click Connect

Follow the prompts to authenticate the connection with Xero, then connect your bank feeds by following these steps:

Select which Xero organisation you want to integrate with Zeller, and click Next.

Select which Zeller Transaction Account to share with Xero, and click Save.

You’ve now set up bank feeds in Xero.

Update your bank feeds

Once your direct feed is connected, statement lines will automatically appear in your Xero organisation — ready for you to reconcile. You will never need to manually upload or update your transactions again.

Transactions from your Zeller Transaction Account are immediately and seamlessly uploaded to your Xero organisation. With Zeller, there’s no need to wait until close of business.

Speed up your reconciliation with bank feeds today

This powerful Zeller and Xero integration is built to save time, reduce human error, and give you an up-to-the-minute view of business finances. Bank feeds bring all of your financial information together in one spot so you can make important business decisions.

As a financial services provider, Zeller is committed to streamlining daily tasks for business owners — giving them back time to focus on growing their business. Stay tuned for more exciting updates to your Zeller account, coming soon.