- Product Updates

Still Invoicing Like It’s 1999? Invoice On The Go with Zeller App.

If you’re still sending handwritten, Word or Excel invoices, you’re living in the past. These days, more and more Aussie businesses are switching their invoicing to Zeller – and it’s easy to see why.

Zeller Invoices makes invoicing easier, reduces time spent on business admin, and helps you get paid faster. In fact, over 75% of invoices sent with Zeller are paid in less than 24 hours.

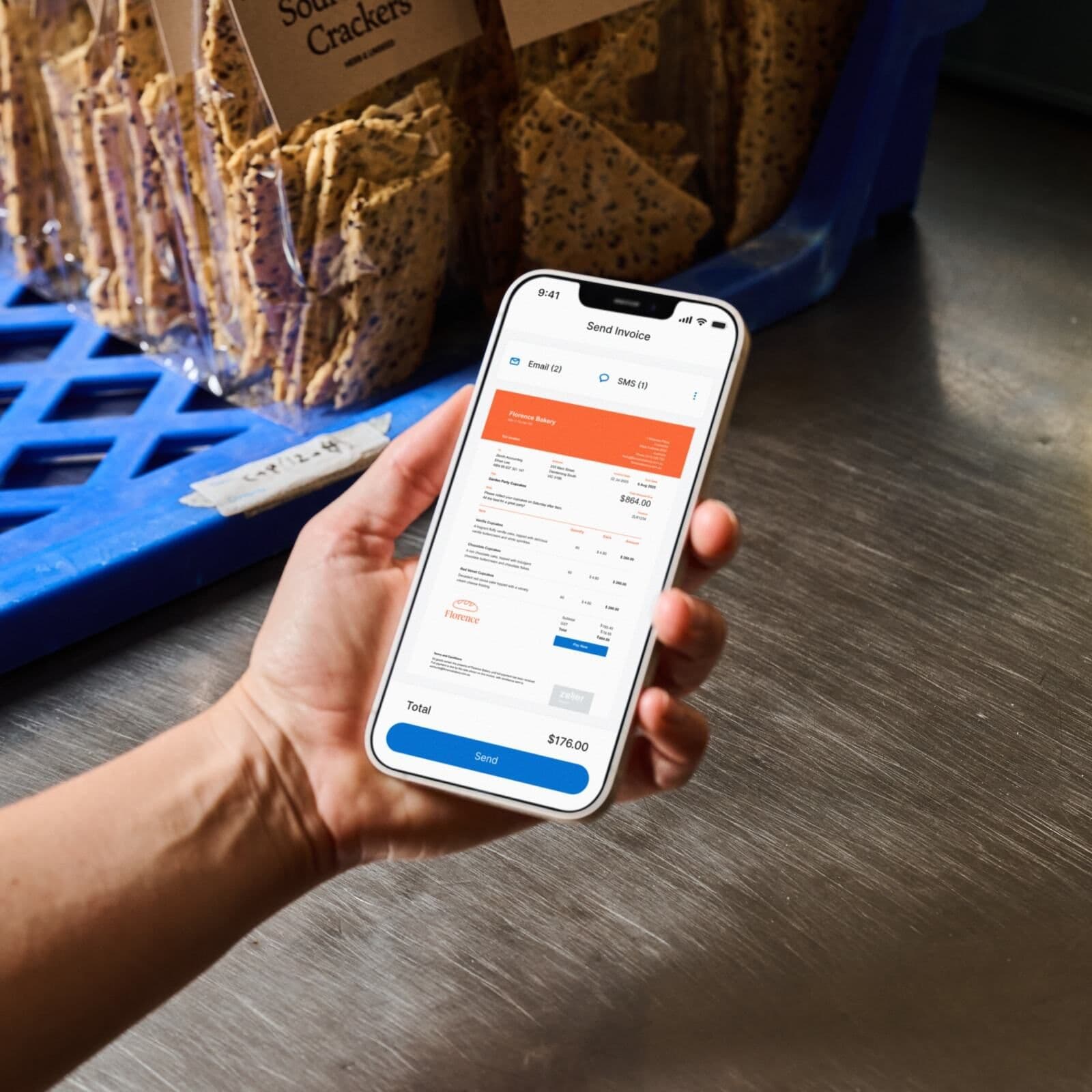

With Zeller Invoices available in Zeller App, you can take care of all your invoicing from wherever you are. Even better, it’s completely free to create, send, track, and manage your invoices.

Create and send an invoice in under 30 seconds.

Over 75% of Zeller Invoices are paid in less than 24 hours.

What you'll find in Zeller's mobile invoicing app.

When you’re issuing invoices on the go, there are features you need to look for in your mobile invoicing app to ensure it will save you time, and make the invoicing process easier. Here are 8 questions we considered when building Zeller Invoices.

1. Is it faster to send invoices? When you’re sending mobile invoices from Zeller App, you can create and send an invoice in under 30 seconds. From suggesting existing items and contacts as you type, to enabling scheduled sends, Zeller Invoices has been meticulously designed to make it easier for you to create, design, and send an invoice from the convenience of your smartphone. Zeller Invoices is faster and easier to use than any other tool we tested in development.

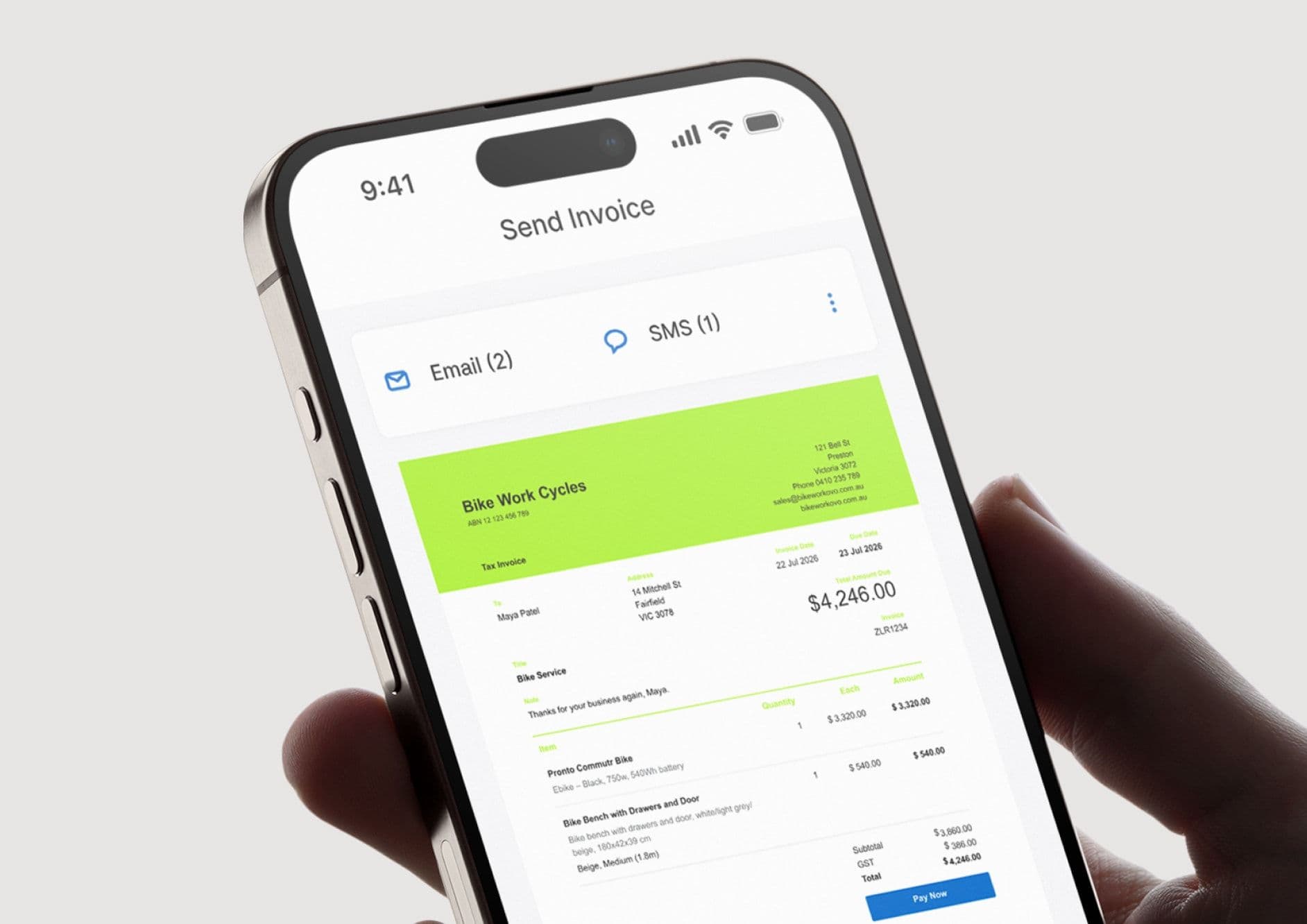

2. Can you still customise and personalise invoices? Convenience shouldn’t have to come at the cost of professionalism or style. With three sleek, customisable templates to choose from, Zeller Invoices look sharp in seconds. Plus you can add your business logo and brand colours, as well as a personalised message, in just a few taps.

3. Does it save you admin time at the end of the day? Traditional online invoicing software keeps you tied to your desktop. But many businesses – such as tradies, freelancers, or mobile vendors – don’t operate from behind a desk during the day. Sending invoices from Zeller App gives you the flexibility to send invoices straight from the job site, saving you time at the end of the workday that you’d typically be spending on business admin.

4. Can you track your invoices in real-time? Whether you’re using a computer or Zeller App, Zeller Invoices enables you to keep tabs on every invoice with a real-time view of what’s been sent, paid, followed up or left overdue – all colour-coded and easy to read at a glance. No more digging through emails or chasing updates. You'll even get a push notification and email to let you know as soon as an invoice is paid.

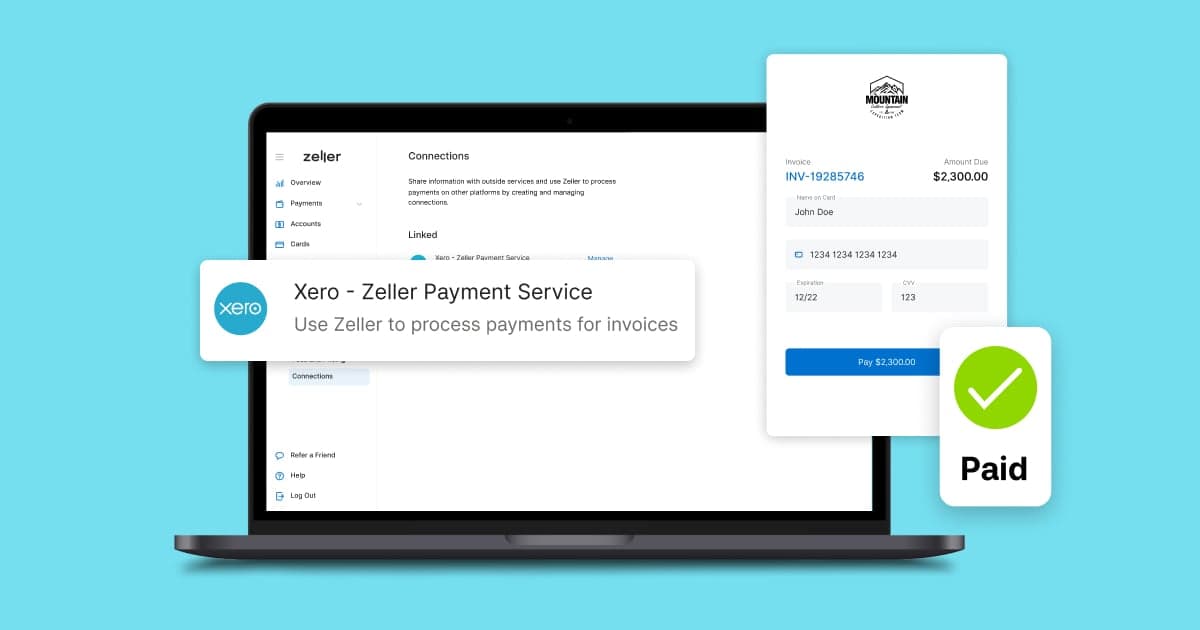

5. Is it easy and secure for your clients? Every Zeller Invoice includes a 3D Secure payment link, so your customers can safely pay in a few clicks using their preferred card.

6. Does it help you receive your money faster? Zeller Invoice payments are settled nightly to your Zeller Account, or next business day to your own, third-party bank account. While many mobile invoicing apps may have you wait 2-3 days to receive your funds, we’ll make sure you’re always getting your settlements fast.

7. Does it offer automated payment reminders? Zeller Invoices on Zeller App has all these same features as the desktop version, including automatic payment reminders. Say goodbye to the hassle and awkwardness of chasing up slow payers – let Zeller Invoices do it for you.

8. Are there costly subscription fees? Unlike most other online invoicing platforms, it’s free to send unlimited invoices with Zeller. You’re only charged a low transaction fee in the event your client chooses to pay their invoice online via credit or debit card.

Compare mobile invoicing apps available in Australia.

When you’re selecting a mobile invoicing app, there are many options to choose from. Compare those available in Australia today, and discover why more businesses are switching their invoicing to Zeller.

Australia’s fastest growing mobile invoicing app for small businesses on-the-go.

Whether you're a freelancer, sole trader or tradie, Zeller Invoices simplifies the invoicing process for both you and your clients.

Ready to level up your invoicing?

It’s easy to start doing all your invoicing with Zeller.

1. Download the Zeller App

Get the free Zeller App from the App Store or Google Play. Sign in with your Zeller Account, or create one online in minutes.

2. Set up your invoice template

Head to Invoices in the main menu of Zeller App, then tap Settings. From there you can upload your business logo, add details for your receipts, customise colours, and more.

3. Create and send your first invoice

Once you’re ready, click the ‘+ Invoice’ button and follow the steps to create and send your first invoice. You'll receive an email and push notification as soon as the invoice is paid.

If you're ready to take the hassle out of invoicing and start getting paid faster, it's time to try the best free mobile invoicing app in Australia.

The ability to add pre-populated items to an invoice makes it a lot faster to create and send, and triggering reminders to customers to prompt them for payment has streamlined my entire invoicing process. I’m no longer wasting hours issuing and chasing late payments — it’s literally saving me hours every week.

Paul Doody

Panda Dry Cleaning & Laundry Services, Victoria.