- Business Growth & Optimisation

Customer Reviews: How to Respond to Positive and Negative Feedback

Your guide to crafting review responses that win over customers and drive more sales.

Online reviews are part and parcel of running any business. After all, customer reviews and ratings are the new word-of-mouth — and the consequences of not having any can be costly. 92% of consumers are reluctant to buy if no reviews are available.

Yet what happens when a poor review threatens to impact business? Thankfully, there is often an opportunity to turn the situation around by taking a complaint on board. Other times, simply protecting your brand image could be the best case scenario.

Either way, it’s important to respond to reviews — whether they’re positive or negative. Keep reading to discover how to use your online review responses to grow your business.

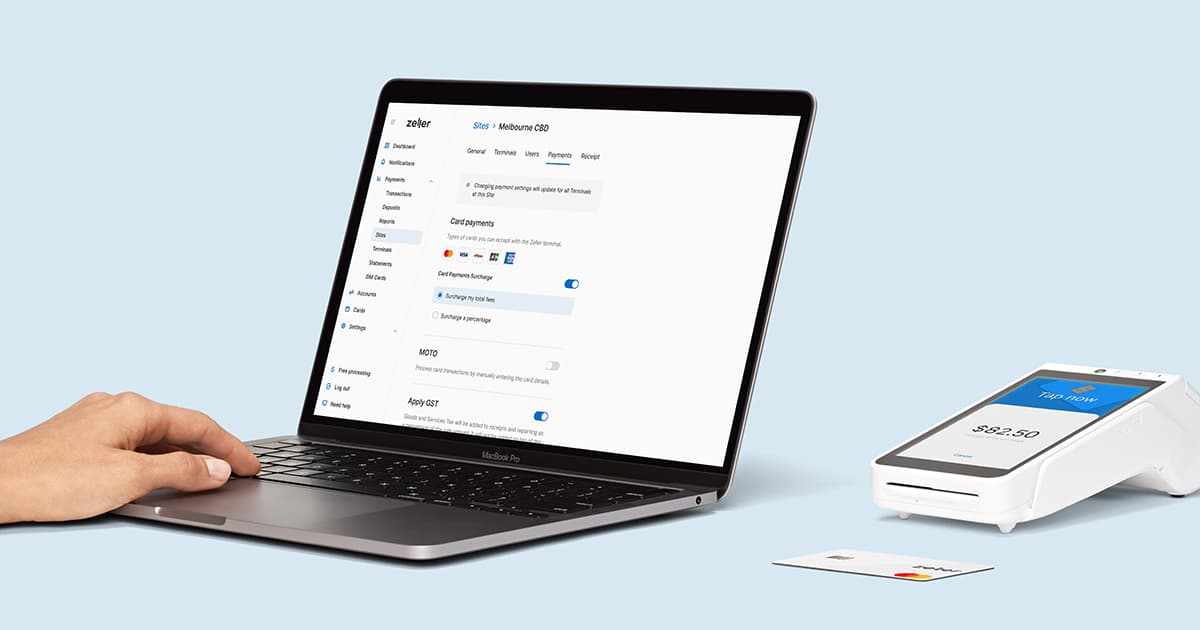

Ready to discover a smarter way to take payment?

Meet Zeller TerminalReady to discover a smarter way to take payment?

How influential are online reviews?

More consumers are reading online reviews than ever, and these reviews significantly influence purchasing decisions. According to a 2022 BrightLocal survey:

67% of consumers will consider leaving a review after a positive experience.

40% will think about leaving a review for a negative experience.

77% of consumers in 2021 always or regularly read online reviews when browsing for local businesses — up from 60% the year prior.

79% trust online reviews as much as personal recommendations.

Whether you run a mobile dog grooming service or a barbershop, beauty salon or busy restaurant, a portion of your customer base will want to give their two cents about your business. Even more potential customers want to read those opinions. Customer reviews can be genuinely valuable tools for improving customer engagement, generating trust, and ultimately boosting sales.

Making the most of review platforms

Digital reviews are critical to customer engagement and business growth. Let’s explore how your business can take advantage of the different review platforms available.

As a business owner, it's highly unlikely that you have bucketloads of time on your hands. It's worthwhile knowing which platforms are worth your effort, and which aren't. In fact, 85% of all reviews come from only four sites.

The world’s go-to search engine and review site, Google — 73%.

Crowd-sourced review/rating platform Yelp — 6%.

Social networking giant Facebook — 3%.

Travel site/app Tripadvisor — 3%.

More consumers are using Google to evaluate local businesses than ever before; 81% googled local businesses in 2021, compared to 63% tin 2020. Plus, with zero-click searches rising to 65% in 2020 and customer reviews helping to boost SEO performance for brands, Google clearly remains the number one review platform your business needs to consider.

The best place to start, if you haven’t already, is by creating a free Google My Business account. You’ll then be able to claim your Google My Business listing, manage your profile across the platform — including Google Maps — and set up notifications to receive reviews instantly.

Google reviews are essential to create credibility and build the reputation of your brand. Google has even confirmed that responding to reviews of any nature increases your website's SEO performance. It raises an obvious question for business owners — how to respond to Google reviews, both favourable and otherwise?

Responding to good and bad reviews

What’s great about having business accounts on each of the above platforms is the scope to proactively manage positive and negative reviews. By responding appropriately to the poor or indifferent as well as the glowing reviews, your business demonstrates its willingness to listen to customer concerns while aiming to exceed expectations.

You might be able to restore the loyalty of a customer following a less than ideal experience, or build an even stronger connection with a happy customer in the moment. At the same time, you’ll show potential customers that you take the customer experience seriously and you’re prepared to acknowledge — and better yet, fix — any quality-of-service issues raised in the public domain.

Tips for responding to good reviews

At face level this appears to be an easy win, and in many ways that’s true. But remember that responding to positive feedback can build on the momentum the customer has already created. How can you add value to this interaction?

Here's how to respond to a 5 star review on Google, or any other platform.

Respond to the message quickly.

Express your gratitude. This shows that you pay attention to all customers — not just the unhappy ones.

Provide additional value where possible — it doesn’t have to be monetary.

Encourage customers to support your business by sharing their review with others.

Record the customer’s feedback so you know what you’re doing well.

Are you getting positive feedback on a regular basis? Here are some examples you can use to make the most of them.

Example 1:

Dear Emma,

Thanks so much for taking the time to post this review and offering such positive feedback.

We pride ourselves on providing a service that exceeds our customers’ expectations, so I’m very pleased to hear about your in-store experience.

Is there anything we can do to make your experience even better next time?

Thanks again for your review, John, Owner.

Example 2:

Dear Jack,

I'm thrilled to hear that you loved your meal at our restaurant.

Our chefs enjoy mixing up the menu with seasonal produce, so I hope to see you here again soon – say hello next time you pop in for dinner.

Thanks again for stopping by, Jane, Owner.

Tips for responding to bad reviews

1 or 2 star ratings immediately stand out for all the wrong reasons. Unfortunately, bad reviews come hand in hand with business. It’s highly likely you’ll receive one at some point. Think of less desirable reviews as opportunities to show off your exceptional customer service skills.

A business that can resolve problems outlined in negative customer reviews can actually end up reaping rewards down the line. Your approach here provides the public with a strong sense that your business really does care about its customers. On the flip side, ignoring poor reviews will only damage your reputation and customer relationships further.

What should you do about a bad review? Here's how to respond to a 1 star review on Google, or another platform.

Evaluate the feedback internally to better understand what has happened.

Publicly respond to the review, without using defensive or frustrated language.

Aim to start a direct conversation with the reviewer through the right private channels.

Be as honest and transparent about any mistakes as you realistically can.

Ask for more information if the details of the complaint are unclear.

Address the specific concerns and look to offer solutions.

If appropriate, offer an incentive or another form of reimbursement.

If you’re confident the customer is satisfied, ask if they would consider updating their review.

Best practices for managing reviews

Finally, don’t forget the following best practices for managing reviews.

Make sure to audit your platforms weekly and respond in a timely manner.

Restrict access to senior staff members only — this ensures no junior staff members are responding to reviews.

Always be polite, courteous and accommodating when responding to reviews and engaging in further communications.

Keep reviews positive with a little help from Zeller

Zeller can help your business with this final, key step of the customer journey by making the payment process as smooth as your customer review responses. Zeller Terminal accepts every common card type (even AMEX), giving customers one less reason to be frustrated. You’ll never need to refuse a customer’s card of choice, or send them to the nearest ATM to get cash out. Payments can also be accepted over the phone.

Your chances of receiving a positive online review will indirectly improve when your business takes the time and hassle out of every transaction. With Zeller, transactions are quickly processed in seconds — which means less chances of queues forming, and a positive transaction experience for all.