- EFTPOS & Point of Sale Solutions

Introducing: Split Payments on Zeller Terminal

The game-changing way to pay that breaks down bills, not friendships.

We've all been there. Smartphone in one hand, bill in the other... frantically trying to calculate who owes what, while attempting to diplomatically account for non-drinkers, vegetarians, and that friend with a penchant for expensive cocktails. Let's face it, splitting the bill is fraught with problems. Not to mention the fact that many venues still don't support it, leaving someone to foot the total sum and chase up afterwards. It's awkward, it's inconvenient, and it's time something changed.

Introducing: Split Payments. A highly-anticipated feature that is taking the guesswork out of group purchases. Businesses using Zeller Terminal can now enable the feature with a single click, and start splitting payments between friends and family today, either by number of people or by a custom value. Read on to discover how to get started.

More flexibility for your customers, more security for you.

While splitting the cost of a group meal or round of drinks is the most common use case, being able to divide payments also offers advantages for non-hospitality businesses. Over and above improving customer satisfaction, being able to divide payments is an important lever for your business to reduce risk and increase sales. In the instance where a customer doesn’t have sufficient funds on one single payment method, dividing the purchase allows them to use a combination of credit cards or digital wallets to pay the total. If your business sells high-priced items, this is especially useful, as it gives your customers a flexible option that makes it easier for them to complete purchases, which can in turn increase sales and reduce the risk of declined transactions.

How splitting payments can increase your tips.

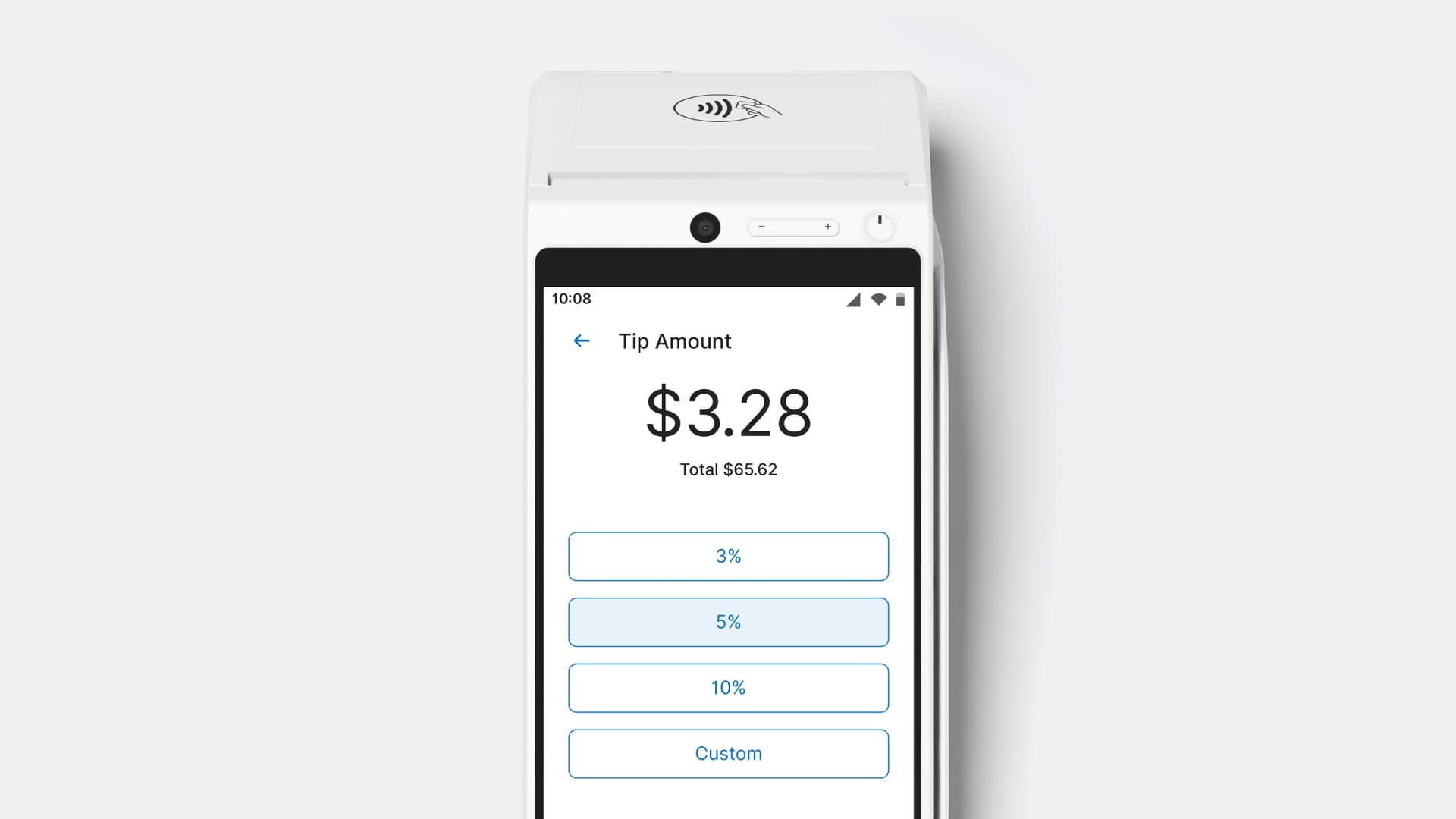

In the service industry, dividing payments is a sure fire way to increase your tips. Rather than leaving the tipping decision to one customer, each individual will be given the option of leaving a tip as they pay their share. Everyone tips differently, so by giving more power to each customer, it is not only a more democratic process, it's likely to result in cumulatively greater tips for your business.

If Tipping is enabled, each split payment has the option of adding a tip.

How to use Split Payments

Enabling Split Payments on Zeller Terminal

The Split Payments feature is configured at the Site level, this means that if you have multiple Sites (eg. different venues) setup within your Zeller Account, you will need to enable Split Payments for each site. Enabling Split Payments within a site will apply it to all Zeller Terminals being used at that site. By default, Split Payments will be turned off. Turning Split Payments on can be done via Site Settings either directly on your Zeller Terminal or remotely via the Dashboard.

From Zeller Dashboard

From the Zeller Dashboard, select Sites

Locate the Site you want to turn Split Payments for

Select the Payments tab

Enable Split Payments and Save

Split Payments will now be enabled on Zeller Terminals within the Site.

From Zeller Terminal

Ensure you are logged in as an Admin or Manager on the Zeller Terminal

From the Navigation Menu, tap Settings

Tap Site Settings

Tap Split Payments in the list

Enable Split Payments and Save

Split Payments will now be enabled on Zeller Terminals within the Site.

Merchants can enable Split Payments via the Terminal or the Dashboard via Site settings.

Using Split Payments

If Split Payments has been enabled, when you go to take a payment on Zeller Terminal, the screen will now display two buttons: Split and Charge. While Charge will take you through the regular payments flow, if you select Split, then your customer will be presented with a choice of how they would like to split, by people or by amount.

Split by People

Zeller Terminal supports the ability to split an amount equally by a set number of people (up to 20). With this option, each person is invited to pay their share (or multiple portions) after which the remaining balance will be shown on the screen, as well as how many portions have been paid for. Customers repeat the payment process until the total amount has been completely settled.

'Split by People' allows customers to split a total into even parts (up to a total of 20 splits).

Split by Custom Amount

If this option is chosen, customers are invited to enter a value to initiate the payment. Once approved, the next payment can be started. On the payment summary screen, customers will now see the new remaining balance, and can repeat this process until the total amount has been settled.

'Split by Custom Amount' allows customers to input a custom amount with the payment flow looping until paid in full.

Transaction record

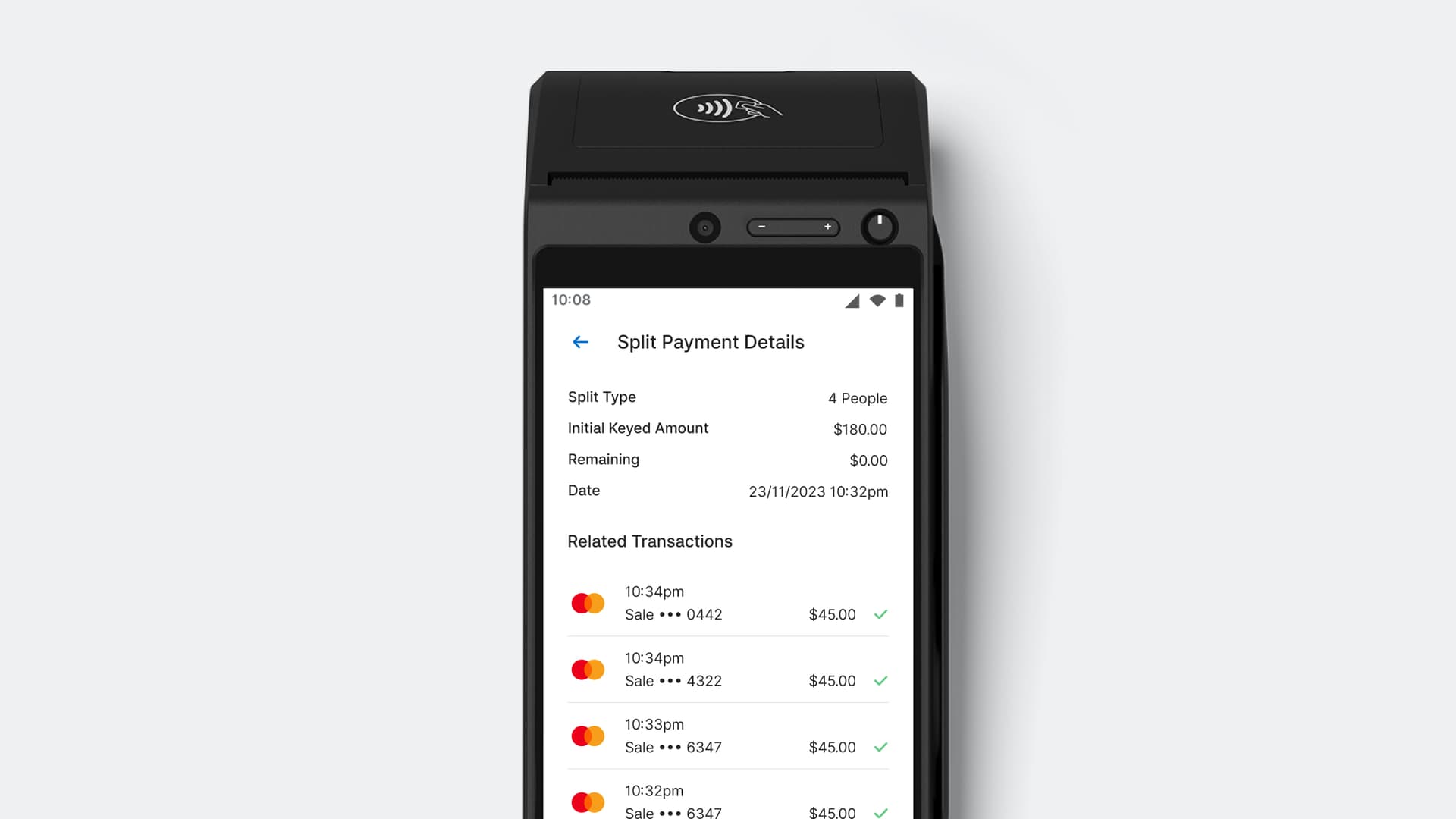

Each split payment is treated as an individual transaction and will be shown in your transaction history list. To keep track of payments that have been split, a new Split Payment Details section has been added to the Transaction Details screen. To see related payments, you simply need to select the transaction and tap Split Payment Details. Here, details of the split payment that the transaction relates to will be displayed, including split type, the initial keyed amount, the remaining balance (in case the split payment was cancelled mid way through), and date and time of the first payment within the split. For easy reconciliation, transactions will include the reference number of payments also completed within the split payment.

Payment transactions will include the reference number of payments also completed within the split payment flow for easy reconciliation.

To receive all our new feature releases and small business news straight to your inbox, sign up to our newsletter here.