- Case Studies

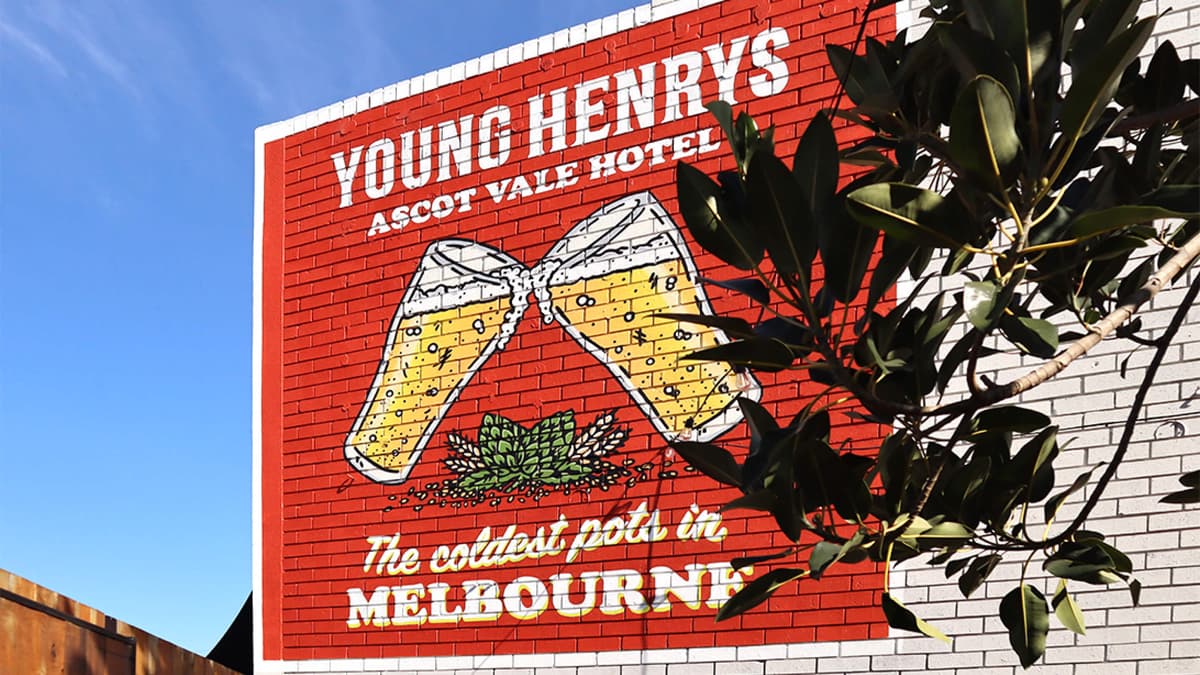

Tapping Into Tech: How the Ascot Vale Hotel Has Raised the Bar on Payments

From splitting payments to surcharging, tipping and sending digital receipts: the functionality of the modern EFTPOS terminal goes above and beyond just settling the bill. We sat down with Bradley Olsson, owner of the Ascot Vale Hotel and Mona Castle Hotel, to talk about using Zeller EFTPOS Terminal, and what specific features have changed the game when it comes to processing payments at speed, improving customer experience, and tracking sales.

Bradley Olsson, owner of the Ascot Vale Hotel and the Mona Castle Hotel

Payment technology has come a long way over the last ten years. How has your current payment terminal made your experience better than what you’ve used in the past?

Bradley: When we started, we were just using the EFTPOS terminal provided by our bank. We were having to deal with a lot of paper dockets, which meant constantly keeping track of them and storing them. We did that for the first 6-12 months, but after a while it just got too hard. When we moved to Zeller the whole process became a lot more streamlined. We were able to send receipts via SMS or email, while still having the option of printing them if a customer wanted one. It meant we only had to have about 10 rolls on site. That was definitely one of the biggest improvements on our old system.

How does tracking sales via the payment terminal help you run your business day to day?

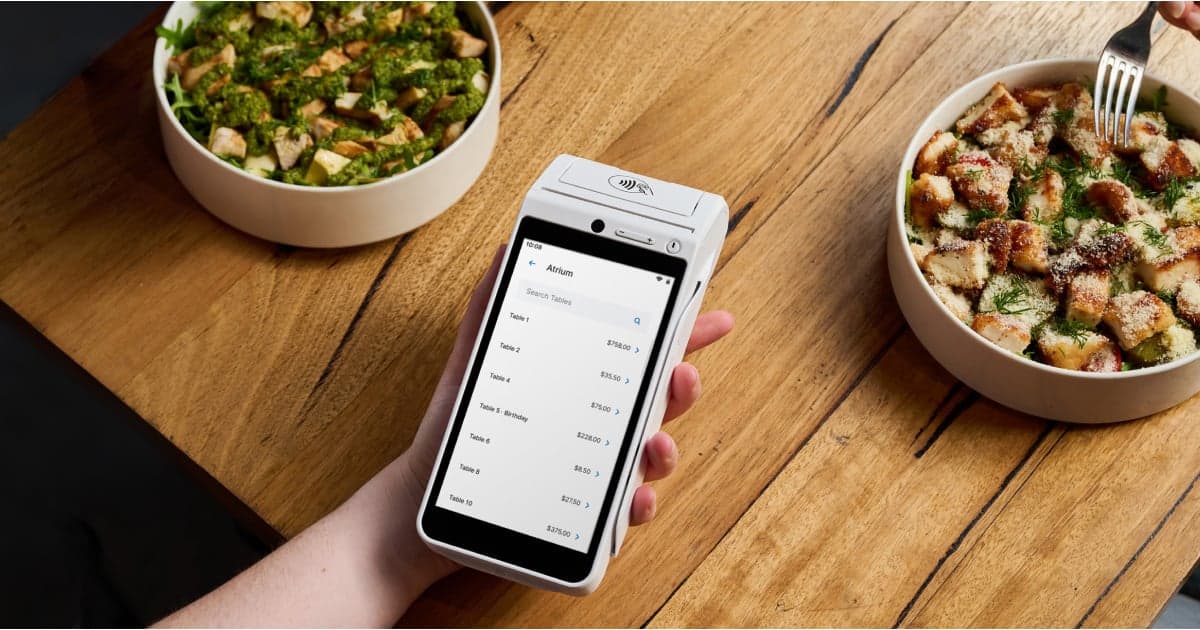

B: With such fast-paced venues, especially the Ascot Vale Hotel, our staff don’t always have time to put orders through the POS. We have six or seven Terminals, and when it gets really busy, they just get passed around, it’s like hot potatoes. So, it’s crazy how big the discrepancy can be; sometimes, at the end of the night the EFTPOS terminal will have recorded upwards of $6000 more than what has been processed through the POS system. Being able to track the sales through Zeller allows us to reconcile them against those that have been put through the POS, which helps a lot with our P&L at the end of the month.

In what ways does Zeller Terminal help you deliver a better customer experience?

B: The interface is a lot clearer for the customers. They can see what they're paying for, including the surcharge that's involved. Our bank terminal had such a small screen, plus you’d always have to plug it in, whereas Zeller Terminal is just much more approachable.

Zeller has recently introduced a ‘Split Payments’ feature, how has this improved the payment process in your pubs?

B: In our dining room which seats about 60-70 people, it really helps. If things are busy, the last thing you want to do is start adding things up in your head. With [Zeller Terminal’s] Split Payments you're just able to offer your customers the option to split it evenly, and away you go. It just helps with processing the payment efficiently, and accurately.

Why is it important that your merchant services provider is an Australian company?

B: At our venues, we really pride ourselves on that personal approach and knowing someone when they come into the pub. So, I guess it's pretty similar with Zeller. I have personally met a lot of the people who work there. It’s nice to always be dealing with the same people. There’s a personal side to it, and that aligns with what we want to achieve in our business too.

Finally, how easy was it for you to get set up with Zeller?

B: It was really easy. Someone came in and helped us with the implementation, and the Terminal is pretty self-explanatory. The maintenance looks after itself and when we do need something replaced it's easily done. The app is also very approachable.

With one low flat fee of 1.4% per transaction for all card types, including American Express, Zeller is not only helping businesses streamline their payment process, but is also softening the blow of rising overheads. To learn more about Zeller’s all-in-one payments solution, visit www.myzeller.com or contact sales@myzeller.com to negotiate an even lower custom transaction fee, if your business is processing over $250K annually in card payments.