- Business Growth & Optimisation

How Do Business Loans Work?

While Zeller doesn’t offer business loans, we know they can be a powerful kick-start. That’s why we’ve put together this guide to help Australian businesses considering whether or not to apply for one.

Every business will have its own financing needs, no two businesses are the same. Some new business owners will dip into their savings or seek loans from friends and family to cover startup costs, while others may choose to apply for a business loan.

In the early days – when your level of cash flow is less certain – a business loan may help you accomplish the growth goals you’ve set for yourself in your business plan. However, with a business loan comes interest – and new business owners can easily make the mistake of locking themselves into an expensive business loan that ties them to a bank long after they begin making a profit.

Before applying for a business loan, learn how they work and whether it’s truly the right direction for your business.

Reasons for a business loan.

Building a business from the ground up often involves significant startup costs. At a conservative estimate, starting a small business can cost around $3,000. The startup costs can even reach as much as $10,000 on the high end. Medium-sized businesses will, of course, require more capital.

Seeking financial help in the beginning phases is a necessity for some, but not all, business owners. Some of the costs involved in starting and operating a business are:

rent or mortgage for a physical location

website domain and software

equipment

technology and payment terminals

products

staff

relevant licences (such as a liquor licence, for example)

Expanding a small or medium-sized business can be equally expensive. It requires another location, more staff, and more products.

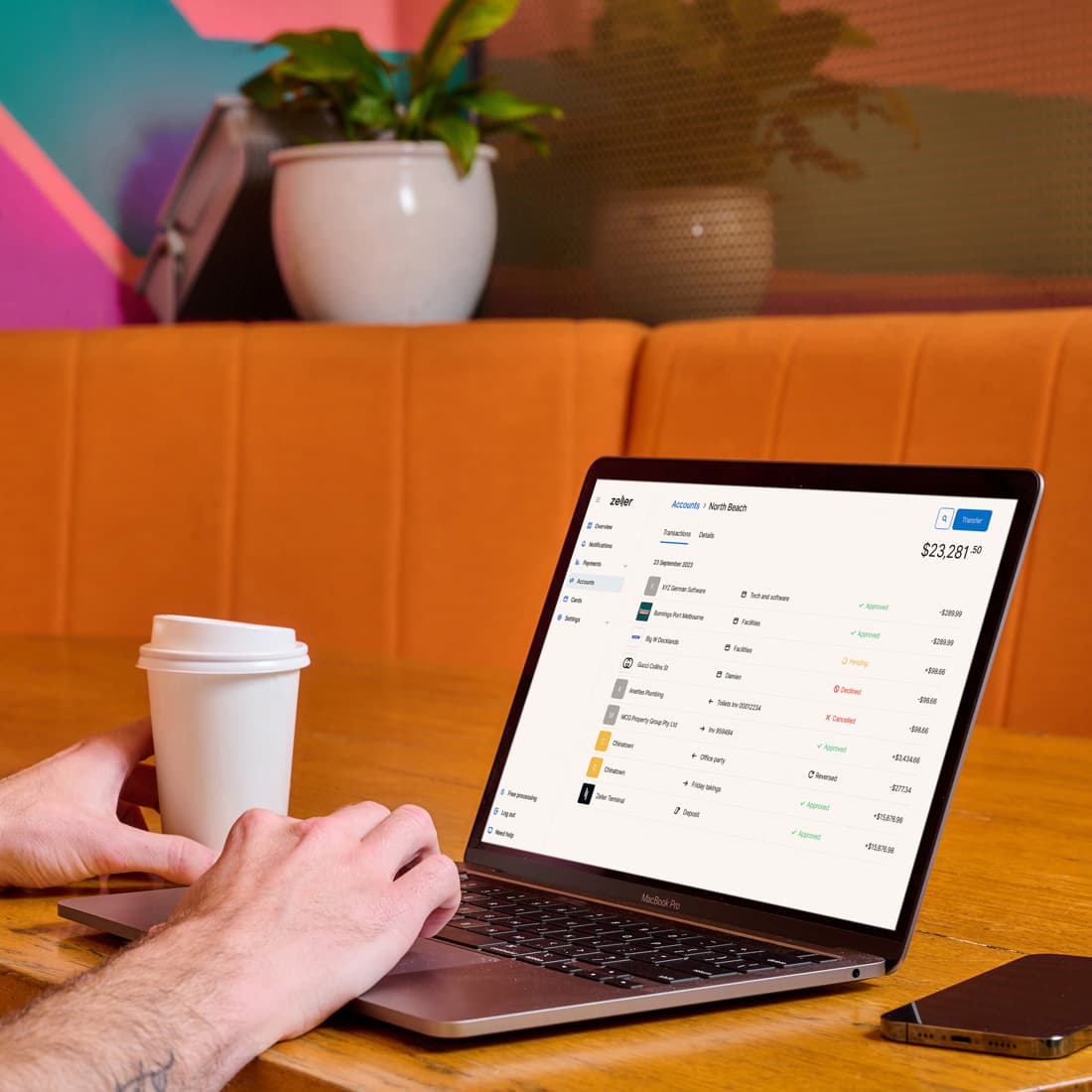

However, if you find yourself in the position of seeking fast access to cash simply to cover your outgoings while you wait for your funds to clear, a business loan may not be the answer. The root of that issue is cash flow, and with faster account settlement a business loan (and the interest that comes with it) is likely an unnecessary expense. That’s why, when you accept payment with Zeller Terminal, the funds are available in your account the next business day — or get your funds even faster by settling to your free Zeller Business Transaction Account.

What is a business loan?

A business loan is quite different to a personal loan, both in terms of the application process and ongoing management.

First of all, personal loans can be easier to obtain. Someone might seek to take out a personal loan due to an emergency situation or other extenuating circumstance. Generally, to secure a personal loan, the banks will consider the individual’s personal credit history and make a decision based on their ability to repay the loaned amount. Whatever that individual chooses to do with the loaned money is more or less up to them; the lending bank usually doesn’t require detailed information about what the money will be used for.

A business loan, on the other hand, requires a more lengthy loan application. Starting or expanding a business can be risky, so many lenders require the loan application to include financial projections and a detailed business plan so they can get an understanding of how and when they will be paid back. Due to the more rigorous application process, business loans can often be larger than personal loans, with a longer loan term.

Additionally, repaying a personal loan can enhance a borrower’s personal credit score, whereas business loan repayment impacts the borrower’s business credit. A business line of credit is similar to a personal one, only it is specific to the success of the business itself. When borrowers pay back their business loans on time, it means they are making enough money to stay afloat, and the business’ credit score reflects that positively. Having a good business credit score can help business owners secure more, and sometimes larger, loans down the road.

Who offers business loans?

Business owners can seek business loans from banks or other financial institutions. Different lenders may offer various types of loans and have different requirements for a loan application. Business owners should research and compare lenders before deciding where to apply. Finder, for example, has a comprehensive list of available business loans in Australia.

It’s important to be careful of scammers when seeking a business loan. Unlicensed companies may contact business owners offering them financial services in exchange for sensitive company information. Business owners should know which organisations to look out for by checking this list of unlicensed companies in Australia.

There are even some organisations in Australia that offer business grants and funding. Business owners can find out what programs are available in their area and which they qualify for by entering their postcode on the Australian government website.

When is the right time for a business loan?

Business loans can be daunting since they are often for large sums of money. But, when a business owner applies for a loan at the right time, they can help a business grow and thrive.

A business owner can prepare to apply for a loan by first compiling a comprehensive business plan. Not only will this give the business owner a good idea of their expenses, but it will also be a supporting document in the loan application.

Once the company is up and running, the business owner should keep diligent records of their earning and spending so they can compile cash flow statements. These can also serve as additional documentation when applying for a loan, and they will inform business owners of their expenses and the potential need for a loan.

The Australian government recommends business owners discuss their finances with a business advisor before deciding whether or not to apply for a loan. A second opinion is often valuable to business owners, since sometimes, their judgment can be clouded by lofty aspirations or idealism.

Types of business loans a lender could offer.

Some lenders will require borrowers to take out a secured loan, which means the borrower will need to offer assets as collateral. Others may allow an unsecured loan, which does not have that requirement. However, an unsecured loan may require the borrower to have an excellent credit history and may also involve a cash advance.

Business owners should do their research before applying for a business loan from a bank or alternate lender. Business loans vary significantly in many ways, some of which could impact the amount of money the borrower pays in the long run.

Some varying aspects of a business loan include:

Interest rate

There are two types of interest rates: fixed or variable. A fixed interest rate remains constant over the course of the loan term, making payments consistent. A variable interest rate will change as the market fluctuates.

Some borrowers prefer the predictability of a fixed interest rate. Some would rather incur more risk for the possibility of lower rates overall, so they choose a loan with a variable interest rate. There’s no one right answer for which is better - it depends on the industry, the borrower’s goals and the amount of risk they are willing to incur.

Loan term

The loan term, or repayment term, will likely depend on the size of the loan. For someone borrowing a sum of money anywhere between $250,000 to 50,000,000, the repayment could take 1 to 30 years. In this case, the borrower will need a long-term loan.

If the business owner just needs to cover a small expense - anything from $5,000 to $250,000 - a short term loan may suffice. These are typically repaid in 3 to 18 months, according to BizCover.

A bridge loan is a short-term loan that effectively "bridges" the gap until the borrower is able to secure more permanent financing.

Fees

A lender may view a business loan as a risk, since the success of the business determines when and if the lender will get their investment back. For that reason, some lenders charge fees for providing loans for added security.

Starting, expanding and even just operating a business already requires significant expenditure. Getting hit with avoidable fees increases overhead and eats away at money business owners could spend growing their companies. That’s why business owners need to make sure they read the fine print of any loan agreement to discover any hidden fees the lender may incur.

Some fees you may see are service fees, payment processing fees, origination fees or potential late payment fees. A low-interest loan may sound great to business owners until they realise how much they could be paying in additional charges.

Financing your business loan.

Whether a business owner secures a short-term loan or a long-term loan, and regardless of the fees and interest rates, they need a strategic plan for financing their loan repayment.

That’s why business owners should create a budget and stick to it. They should also always be aware of the company’s cash flow. This is best monitored with day-to-day bookkeeping and by analysing the merchant statement every month.

When business owners have a good understanding of their working capital — the amount of money they have available to use for day-to-day business operations — they equip themselves with the knowledge to make smart spending moves without compromising their ability to repay their debts.

Business loans work in the favour of a growing company as long as the business owner is organised and makes adjustments to their spending and pricing whenever necessary. Small and medium businesses alike can benefit from business loans when they are used strategically, however if you can by without one you'll keep more money in your business because, at the end of the day, a business loan comes with interest.