- Zeller for Startups

How to Raise Funds for your Startup

Bootstrapping uses personal funds to fund your startup while retaining ownership.

If you ask friends and family for early funding, ensure you have clear terms in writing.

Apply for government grants to get non‑repayable funding for growth.

Join accelerators to access mentoring, networks, and seed capital.

Consider angel investors or VCs for larger investment and strategic support.

Raising capital is one of the biggest challenges facing Australian startups.

In fact, in a recent survey by Zeller, 94% of local tech founders cited fundraising as their top hurdle, followed by financial management.

If you're an early-stage founder wondering how to secure funding in Australia, you're not alone. The good news is that these days there are more funding options available than ever, from government grants and accelerators, to angel investors and VCs.

This guide outlines the different paths to fundraising for your startup, along with tips to make the most of each option.

Bootstrapping and self-funding

Bootstrapping simply means using your own money – whether that’s your savings, income from a day job, or early sales – to fund your business. It’s the most straightforward way to retain full control and ownership as you don’t have to give up equity or answer to external investors, making it ideal if you want to build on your terms.

But bootstrapping demands discipline. You’ll need to stretch every dollar as far as you can, track your expenditure closely to ensure you’re keeping costs down, and focus on reaching profitability fast. This often involves launching with a minimum viable product (MVP), finding low-cost marketing strategies (such as referral programs or leveraging social media), and maintaining a lean operation. Many successful startups begin this way. That said, bootstrapping isn’t ideal for every business.

If your startup requires significant upfront capital – such as for product development, engineering, technical infrastructure, inventory, or team recruitment – you'll likely need the support of external funding. Still, even a short period of bootstrapping shows investors you're dedicated and know how to responsibly manage your startup finances. Having some traction before raising money can also lead to better terms.

Pro tip: Document your early wins. Investors like to see founders who’ve achieved progress with limited resources as it signals resilience and vision.

Fundraising from friends and family

Once personal funds start running low, founders sometimes turn to friends and family for limited initial capital raising. These people already believe in you, so they might accept a higher level of risk than a VC or professional investor. It’s a common early-stage funding step, especially if you require modest capital to develop a prototype or reach your first customers.

Still, it should be approached with care. Even though the relationship is personal, you should treat it like a business deal. Be clear about whether the money is a loan, a gift, or an investment, and formalise everything in writing. Using tools like SAFE notes (Simple Agreement for Future Equity) or convertible notes allows informal investors to gain equity later, once you raise a proper round.

Raising money from loved ones can strain relationships if things don’t go well. Only take what you truly need, and make sure everyone understands the risks. Some startups go years before returning capital to early investors – and some never do.

Government grants and support programs

Australia offers a wide range of government support for startups. Unlike loans or investment, most grants are non-dilutive and don’t require repayment, making them a valuable source of early-stage funding.

The most well-known is the Research and Development (R&D) Tax Incentive, which refunds up to 43.5% of eligible R&D expenses. If your startup is working on new technologies, this can significantly reduce burn. Another popular program is the Export Market Development Grant (EMDG), which helps cover international expansion costs.

There are also many state-level grants and startup challenges. For instance, LaunchVic in Victoria offers funding and support for innovation-focused businesses. In New South Wales, the Minimum Viable Product (MVP) Ventures Program provides grants ranging from $25,000 to $50,000 to help startups commercialise innovative products or processes.

These grants often require businesses to meet criteria around location, industry, or stage.

If you haven’t already, check out the government’s Grants and Programs Finder to see if there could be something suitable for you. Applying can be time-consuming, but the payoff is often worth it. Be ready to justify how the funds would be used and how they’d contribute to your growth.

Startup accelerators and incubators

Accelerators and incubators support early-stage founders through mentoring, resources, and often seed funding. Accelerators typically run structured programs over a few months, ending in a pitch event or demo day. In exchange for equity, they may offer anywhere from $50,000 to $150,000, alongside intensive business development support.

Well-known Australian accelerators include Startmate, muru-D, and BlueChilli. These programs are competitive, but graduating from one can significantly boost your credibility and access to investors.

Incubators are less structured and may not offer funding but provide office space, mentoring, and networking opportunities. Some are affiliated with universities or corporates and help commercialise research or develop early-stage ideas.

The non-monetary benefits of these programs – exposure, mentorship and networking – can be just as valuable as the funding itself.

Crowdfunding

Crowdfunding has grown as a legitimate funding path for startups, and there are two main types:

Product crowdfunding: Platforms like Kickstarter or Indiegogo let you pre-sell a product in exchange for future delivery or rewards. It’s ideal for consumer goods, gadgets, or creative projects, and helps validate market demand, but it requires a strong campaign and careful fulfillment planning. Most platforms are all-or-nothing – if you don’t hit your goal, you get nothing.

Equity crowdfunding: Since 2018, Australian startups can raise up to $5 million per year from retail investors in exchange for equity, using platforms like Birchal, Equitise, and OnMarket. This opens up your funding to the general public, and is especially effective if your brand has community appeal.

Crowdfunding is a marketing effort as much as a fundraising one. You'll need a compelling story, strong visual assets, and a plan to engage directly with supporters to maximise your investment potential. It can be a good option if you want to build brand awareness while raising capital.

Angel investors

Angel investors are high-net-worth individuals who fund startups, usually in early stages, with investments ranging from $10,000 to several hundred thousand dollars. Australian groups like Sydney Angels and Melbourne Angels are actively investing in startups across various sectors.

Angels are often former founders or industry veterans, and many provide mentorship and strategic guidance in addition to capital. They typically invest via SAFE notes or convertible notes, which delay equity valuation until a future round.

To attract angels, have a solid pitch deck, an early product or traction, and a clear growth plan. Research angels who align with your sector or business model. Getting an angel on board can lend your startup credibility and help you reach larger investors down the track.

Venture capital

Venture capital funding in Australia is competitive, but thriving. Firms like Square Peg, Apex Capital Partners, Blackbird Ventures, and AirTree back high-growth companies with multi-million-dollar investments across a longer-term partnership.

VCs (venture capitalists) are looking for businesses with large addressable markets, scalable models, and traction – not just ideas. You'll need a proven team, a strong product, and revenue or growth metrics (be it firm projections, or realised figures). The VC process includes extensive due diligence, so be ready to share your financials, projections, and cap table.

VCs may sometimes also take a board seat and expect a say in key decisions. While they can accelerate growth, VC funds come at a price – dilution and control. Be sure that venture funding aligns with your company’s goals before pursuing it.

If you’re looking at getting VC investment, warm introductions through other founders, angels, or accelerators can significantly improve your chances of getting a meeting.

Business loans for startups

Loans offer a non-dilutive path to funding, which can be attractive to startup founders who want to retain full ownership and control.

Traditional lenders may require a trading history, collateral, or a personal guarantee. These hurdles can make loans difficult to secure early on. However, if you have existing revenue, purchase orders, or assets, you might qualify.

Alternative and fintech lenders, like Prospa or Capify, offer faster application processes and unsecured options. Be cautious – interest rates can be higher, and repayments start immediately.

Some founders use credit cards or overdrafts to manage short-term cash flow. While risky, it can work if the borrowed funds drive growth that covers the debt. Only borrow what you can realistically repay, and make sure any debt supports revenue-generating activities.

Pitch competitions and startup events

Startup pitch events can be a great opportunity to refine your pitch, build visibility, and meet investors. Across Australia, competitions range from university challenges to major events like StartCon or SXSW Sydney, where prize pools can reach six figures.

You might not win every contest, but participating builds your confidence, sharpens your story, and connects you with the ecosystem. Winning smaller awards can also add up and provide early, non-dilutive capital.

If you decide to compete, make sure to tailor your pitch to the judges and practice until it’s smooth. Use any prize money strategically to hit meaningful milestones, like launching your product or scaling up your marketing.

Set yourself up for financial success

Raising capital is only half the equation. Once you have funds, managing them wisely is equally crucial. Many founders struggle with outdated banking tools and disjointed systems when they simply don’t have to.

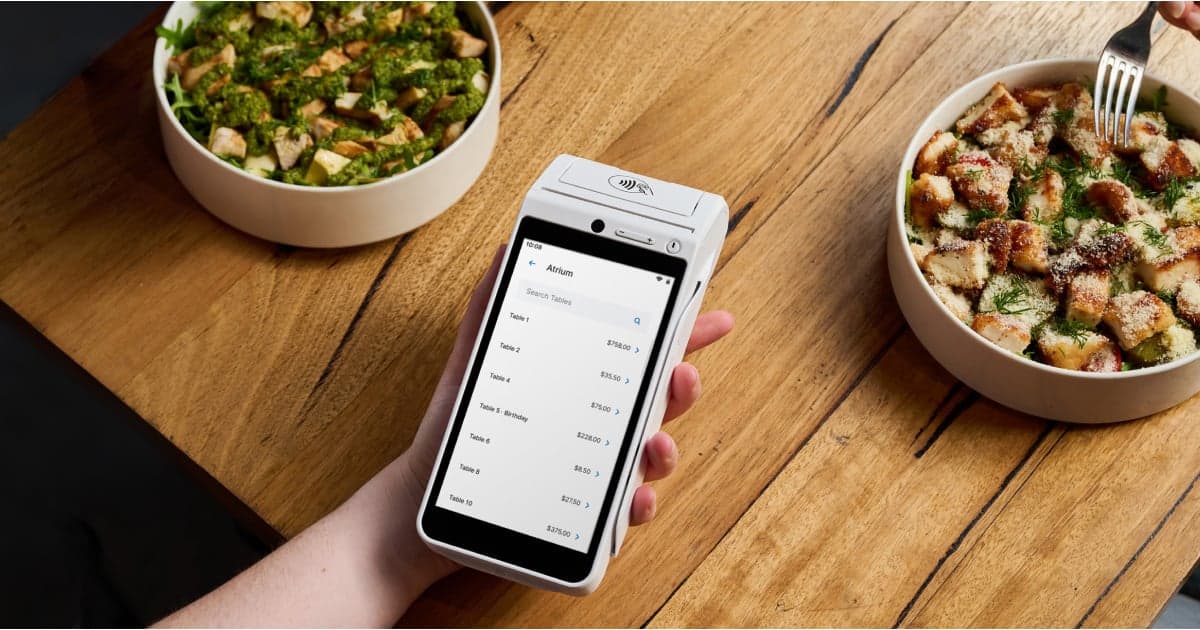

Modern platforms like Zeller for Startups provide banking, payments, and expense management all in one place, streamlining the finance side of things considerably.

Pro tip: Be sure to open a dedicated business account, like a Zeller Business Transaction Account, to keep your personal and business separate. Plus, you can integrate it with accounting tools like Xero or MYOB to streamline your tracking and reporting.

Make it work for you

There’s no one-size-fits-all approach to raising funds. Most startups use a combination of bootstrapping, grants, investors, and competitions to grow. Stay flexible, persistent, and realistic. Every rejection is an opportunity to learn something – about your pitch, your timing, or your market.

Finally, remember that the end goal isn’t securing funding, it’s building a successful, sustainable business, so make sure your capital is always fuelling progress, not just buying time.