Payments Trends: How Will Your Business Be Impacted?

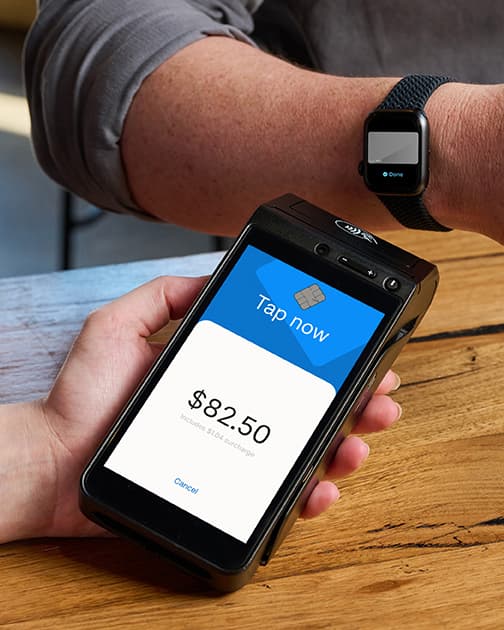

Use of alternative payment methods is skyrocketing. In the digital world, change is rapid. Payment options and alternatives are frequently evolving — as are your customers’ expectations. People expect to be able to transact with the businesses they buy from, quickly and conveniently, no matter which payment method they choose. Some may even go as far as to only transact with those businesses that accept a particular method of payment. As consumer preferences continue to evolve, it’s going to become increasingly difficult and time-consuming for businesses to play catch-up. Those that keep themselves informed of these shifts in expectations stand the best chance of winning and retaining customers in the competitive small business world. Welcome to Payments 4. X A new age is dawning within the payments industry. This era, dubbed “Payments 4. X”, will see a focus on personalised customer experience, industry consolidation and new tech industry players — offering business owners and their paying customers alike “ smarter experiences and smarter interactions ”. But what sparked the change? Payments 4. X has been ushered in by an unprecedented push for contactless payment options, faster transaction settlements, and foolproof security. The most straightforward explanation of the shift comes from Capgemini's 2021 Global Payments Report , which provides an in-depth look at how payments have changed over the last year, as well as the various ways in which the COVID-19 pandemic has shaken the industry up and created new opportunities for merchants to improve the way they run their business. Access the entire global report online , or keep reading for the short version: a distillation of 5 payment trends that will likely impact small business owners in Australia as we enter the age of Payments 4. X. 1. Connected systems The success of any business hinges on its people, processes, and systems. As new tools and apps continue to be developed, the success of a business will increasingly depend on its tech stack. The ecosystem of tools you piece together will impact everything from how you communicate with your customers, to the ease of running promotions, to the time it takes to report on business performance. Integrating your EFTPOS terminal with your point-of-sale system, for example, will enable you to select a customer’s item on-screen and have the transaction amount immediately appear on your terminal — ready for the customer to tap, dip, or swipe to pay. An interconnected system will also make real-time data accessible, enabling you to make quick decisions for the betterment of your business. For your customers, connected systems mean a better experience; more personalised, more efficient, more fulfilling. As tech companies continue to develop products built on the software-as-a-service model, businesses of all shapes and sizes will be able to create their own modular value chain of tools. This plug-and-play tech will enable those merchants who spend time comparing and selecting tools that work well together to save time, build better customer relationships, and grow profits. Perhaps most importantly, spending the time to find the right systems will enable you to run your business in your own unique way. 2. A new type of consumer credit Buy Now, Pay Later schemes (BNPL, for short) are exactly what they sound like. A customer can buy a product now, for a small amount of money, and pay the balance later — no need to wait for payday. In removing these hurdles for customers, they’re more likely to spend. An American study found that businesses that offered their customers to option to buy now, pay later experienced a 20 to 30% uplift in conversion rates. 80% of those that began offering BNPL saw an increase in the amount customers spend in-store. Unsurprisingly, BNPL has exploded in popularity — especially amongst younger generations, where trends come and go quickly. The way they’re using the platforms demonstrates a clear preference to debit over credit; according to Afterpay, 94% of its Gen Z users are opting to buy now, pay later using their own money rather than link their account to a credit card. This is the same generation that commonly reaches for their phone or extends their wrist when it comes time to pay. Anyone with a bank account that meets a set of standard eligibility criteria can sign up for a BNPL scheme to buy whatever they want at stores that accept the payment method. Essentially, that means anyone over the age of 18, with a bank account, who passes a credit risk check can use BNPL. If your business doesn’t already accept BNPL as a method of payment, consider whether 2022 is the year to start. It could be a way to reach a new subset of customers whose spending power is increasing with time, and grow your profits. 3. No more cash The pandemic has hastened the pace of cash’s decline even faster than predicted. In 2020, cash was used for just 20.5% of transactions at a point of sale across the globe. That’s a 32.1% reduction in cash use since 2019. Companies like FIS, for example, previously speculated we would reach these levels in 2023; the pace of decline is three years ahead of schedule. In Australia, we are even further ahead of the pack; cash has been approaching legacy status as a payment method for years. Cash is used for less than 20% of point-of-sale transactions in the Asia-Pacific region, and it’s expected that by 2024 it will account for less than 10% of those transactions. So, how are consumers paying? With their new limb: the mobile phone. Nearly 45% of consumers say they frequently used their mobile wallet to pay for things in 2021 — meaning almost half of consumers reached for the mobile wallet upwards of 20 times. A year prior, just 23% of consumers did the same. This is good news for businesses; the less frequently your customers pay with cash, the less time you’ll spend counting your cash drawer, visiting the bank, and waiting to be able to put those funds to work. Instead, simply accept payment through Zeller Terminal and the funds will be available in your Zeller Transaction Account the very next day. Spend them using your Zeller Mastercard . 4. Innovative forms of payment There’s no question that COVID has accelerated the adoption of digital wallets while speeding up the decline of cash. However, consumer payment preferences are growing increasingly diverse. With Payments 4. X ushering in an accelerated transformation timeline, every business owner needs to take stock. How will your customers expect to be able to pay in 12 months’ time? Credit card use is expected to flatline. There’s an abundance of payment methods available, and more to come. What was once considered an ‘alternative payment method’ — such as a digital wallet attached to a mobile phone or smart ring — is now mainstream. Cash won’t simply be replaced by credit cards and mobile wallets. Remember, the technology powering NFC-reliant digital wallets is still in its infancy. As younger generations embrace these newer payment methods with gusto, the trend accelerates — indicating there’s more change to come. Is your business prepared? Convenience is key; when a new payment trend emerges, you’ll want to ensure your EFTPOS terminal can meet your customers’ needs by accepting whatever form of payment is most convenient. 5. An even faster pace The pace of innovation and competition within the industry has sparked a change in consumer expectations: everything must happen quickly. Near instantaneously. Consumers have gotten used to fast transactions, and are increasingly expecting the process to become faster and faster. In this instance, a ‘consumer’ in a digital transaction refers to both: the customer of the bank (i.e. the business carrying out the transaction and accepting funds) the customer of the business (i.e. the person who is making a purchase). Both expect the transaction to happen swiftly, meaning instant payments and quick transaction settlements are already table stakes. Businesses need the ability to quickly and seamlessly process transactions, so customers can pay and continue with their day without disruption. This includes the ability to quickly identify the reason for a declined transaction , and being enabled with the information to quickly correct the issue and progress the sale. However, increased transactions volumes and instant processing requirements are stretching the banks’ decades-old legacy payments infrastructure. Nimble payments providers will be able to adapt to change and offer their users the most forward-thinking solutions, so that you can offer your own customers a great payment experience. Preparing your business for Payments 4. x The picture the Global Payments Report paints is overwhelmingly positive, despite the obvious challenges. Innovation is opening significant opportunities for payment providers to step up and differentiate themselves as forward-thinking companies that can keep up with the pace of change, and build the functionality that enables businesses to take advantage of those changes. As a merchant, it’s up to you to ensure that every one of your customers has a positive payment experience. Whether you are able to accept a customer’s method of payment, troubleshoot a declined transaction, or even continue operating in a thunderstorm depends on your EFTPOS provider. It's an important choice that will have an impact on the way you run your business for years to come. By sharing your details with us, we may contact you from time to time. We promise we won’t bug you — and you can unsubscribe from communications at any time.

Meet Zeller: we’re reimagining banking for Australian businesses

Accepting payments, managing your finances, and paying recipients should be simple. Unfortunately, this isn’t always the case. Our research shows the majority of Australian business owners are dissatisfied with their business banking. The truth is, most merchant services solutions aren’t built to help your business thrive. That’s where Zeller comes in. Today, we’re launching Zeller — giving Australian merchants affordable, accessible, and innovative tools that enable businesses to get paid, access their money, and manage cash flow — without ever having to set foot inside a bank. We’re reimagining business banking through powerful new technology, backed up by local support and personalised service. An innovative SME alternative to business banking “Innovative” isn’t a word usually heard in the context of merchant services. Finding integrated financial solutions to grow and support your business often requires you to weave together multiple products from different providers, which typically means longer processing times, more paperwork, and a more frustrating experience. Large enterprises benefit from financial solutions tailored to their specific needs; traditional banks have shown that they’re more than willing to pour resources into supporting big business. However, this comes at a cost to the everyday Aussies behind our small to medium sized businesses. SME owners are typically forced to fit the traditional banking mold, suffering through archaic onboarding processes only to be hit with high fees, lock-in contracts, and slow processing times when the paperwork is complete. For new business owners, this can present what seems like an insurmountable hurdle to starting and growing a venture. With 67% of businesses stating they would prefer a non-Big 4 bank, it’s clear that Australian business banking is fundamentally broken. A lack of innovation from the incumbents means merchants like you are overlooked and underserved, at a time when they should be thriving. Businesses need new tools, technology, and support to grow. And that’s why we built Zeller. What’s in the box Zeller is all-in-one payments and finance solution for Australian businesses. It helps to accelerate your business cash flow by giving you a next-generation EFTPOS terminal, a free business transaction account, and free business Mastercard, all in one box. 1. Zeller Terminal Our research revealed that 71% of business owners using clunky EFTPOS terminals regularly consider switching providers. High costs and expensive fees, slow deposits that impact cash flow, and a lack of local support are all common reasons for businesses looking to switch. The majority of Australian business owners are dissatisfied with outdated EFTPOS technology currently on the market. Zeller Terminal is an all-in-one card payment and EFTPOS solution. Our next-gen payment terminal allows you to accept every payment from every customer – Zeller Terminal accepts contactless devices, contactless cards, chip cards, magstripe cards, and will soon also accept alternative payment methods such as Alipay and ZipPay. As new payment methods continue to emerge and shape the way Australians pay for products and services, Zeller Terminal will adapt to support Australian businesses to grow. Read more about Zeller Terminal . 2. Zeller Transaction Account We understand that being able to effectively manage and access your cash flow is key to the long-term survival of your business. That’s why we make sure your funds are available as quickly as possible after taking payment from a customer. Zeller Transaction Account is included free when you sign up for Zeller. Your account is instantly ready to use, giving you real-time visibility over your settlements and spending — no lengthy paperwork required. When you take payment through Zeller Terminal, funds are settled directly into your free Zeller Transaction Account within the day. You also have the option of sweeping your funds into any existing bank account, and they’ll be accessible as soon as your bank allows. Read more about Zeller Transaction Account . 3. Zeller Mastercard By giving you the tools to accept payments, store and settle funds, and spend your money, we're significantly reducing the time it takes for you to get access to your funds. According to the Australian Bureau of Statistics, more than 60% of small businesses close within their first three years — and the most cited cause for business failure is poor cash flow. As a business owner, fast access to your funds to pay your staff, suppliers, or buy product, is imperative. Read more about Zeller Mastercard . By seamlessly combining these services into a fully integrated solution, Zeller significantly reduces the time businesses spend on finding a merchant services provider, completing lengthy applications, getting set up, and connecting disparate payments and financial services solutions — all while speeding up your business’s cash flow. Watch the video to see how Zeller works in more detail. Your business, your way Merchant services should work the way your business needs, allowing you to pick and choose the business banking products you need to sustain and grow a profitable business. With Zeller, you have the option to choose the parts you need – Zeller Terminal, Zeller Transaction Account, and Zeller Mastercard work just as powerfully together as an integrated solution as they do alongside your existing products. Learn more about our EFTPOS machines and how our newly launched products are changing business banking for the better.

7 Creative Ways to Overcome Australia’s Workforce Shortage

Don’t let labour shortages stifle your business's growth. Does your business have enough staff on the payroll to get through the festive season? If not, you’re not alone — restaurants and cafes, bars and pubs, and retailers are crying out for workers. As labour shortages reach dire new heights, businesses having enough staff to ride out the holidays could just be the biggest Christmas miracle of all. Faced with a veritable economic hibernation over the last two years, merchants in Victoria and New South Wales in particular are having to get back to business without one key resource: a full team. Combined with fractured supply chains and spending urgency, businesses all over Australia are more desperate than ever to attract workers — with bigger businesses offering eye-watering wages and expensive perks that smaller businesses simply can’t compete with. So, if you can’t find more workers, what can you do? Keep reading to learn more about Australia’s labour shortage, and discover some creative solutions you can implement to get your business through the Christmas season shorthanded. What is a labour shortage? Simply put, a “labour shortage” means there are more jobs going than workers to fill the positions. This particular phenomenon has been brought about by Australia’s pandemic recovery, however the concept itself isn’t new. Major economic events, such as the Global Financial Crisis , have triggered labour shortages before — as has generational retirement and geographic population shifts. The issue that has sparked today’s labour shortage is, of course, the pandemic. Over the last two years, an alarmingly large number of retail and hospitality businesses have been forced to let workers go to minimise financial pressure. Now, those same businesses are being forced to cut business hours and services because they don’t have the staff required to trade as normal. Alarmingly, the current labour shortage has been ongoing for some time — and small Australian businesses are paying the price. In March 2021, 42% of small businesses reported having job openings they couldn’t fill. Fast forward six months, and the situation has become increasingly dire. Recent data from Seek shows job ads across Australia have risen to the highest levels in two years. Suffice to say, Australian businesses want to grow — but a lack of workers is stopping them. How are businesses dealing with the labour shortage? The severity of the shortage is hurting businesses of all shapes and sizes, and small business owners in particular are feeling the pressure. With countless positions open across Australia, small business owners are struggling to move at the speed required to secure workers — most likely because they have their hands full, keeping the wheels turning. Another reason is that small business owners are unable to match the incentives offered by big businesses. One company going to extreme lengths to source labour ahead of the holidays is Australia Venue Co, which operates more than 170 hospitality venues across Australia. This festive season, they’ve launched an ambitious recruitment drive to lure 500 hospitality workers from the UK with promises of free flights and $1,000 vouchers — perks a small business owner simply cannot compete with. Similarly, some bigger businesses are offering paid training and $1,000 bonuses to workers who stay for more than three months — while a Sydney restaurant is recruiting dishwashers at $90 per hour . So, short of emptying your pockets to grow your team, what can small businesses do to battle the labour shortage? How to combat a shrinking workforce 1. Raise your wages Rest assured, you don’t need to raise your wages to a whopping $90 an hour. However, boosting your rate is a good place to start. Some workers feel they are being paid better by unemployment programs than by businesses. Similarly, others remain uneasy about returning to work and don’t feel like low wages offset the risk. The secret to increasing hourly rates without hurting your bottom line is to look for savings elsewhere. Are there any costs you could cut, such as in supplies, services, or advertising? Can you raise your prices ? Could you cull any unpopular services or products, or explore some additional revenue streams that aren’t labour dependant? The important thing is to think of raising wages as an investment in your workers, and in the future growth of your business. 2. Introduce work perks That investment could also take the form of appealing incentives. These don’t have to be four-figure checks or bonuses, but instead something as simple as a free meal during their shift or an employee discount. In essence, if you can’t afford to boost wages, get creative. Perhaps there’s training costs you could cover, or social events you could host for your team. One of the biggest incentives at your disposal could even be converting part-timers to salaried employees, who’ll then have leave and super benefits. You could also consider performance bonuses to incentivise productivity. The trick is making your workers feel valued. When they do, they’re likely to not only work harder, but stay with your business for longer. 3. Introduce flexible hours The pandemic has highlighted the value of a good work-life balance. After spending more time at home with family, up to 60% of Australians don’t want to return to business as usual. Instead, they're seeking greater flexibility. By proactively accommodating these needs, you increase the appeal of your open positions. Something as simple as a smart employee scheduling app can do all the heavy lifting when it comes to factoring in staff preferences for shift scheduling, accommodating desired hours and times of day to keep staff happy. 4. Cast a wider net If you’ve been rehashing the same old job description every time there’s an open position in your business, consider reviewing it. Are there any skills you can teach on-site? Immediately, you’re opening the job up to the thousands of new apprentices — whose training could be largely supported by government assistance . Similarly, if you’re turning to the same hiring channels every time, consider exploring some new ones — such as social media, staffing agencies or recruitment tools. Something as simple as a video ad on Facebook or Instagram can be infinitely more effective. Candidates spend 316% more time considering a job description when it’s in a video format. 5. Make applying effortless Sometimes it’s the application process itself that’s turning away potential hires. Make sure your job ad and position description includes key details, such as duties, desired requirements and pay rate. That way, potential applicants can see — at a glance — whether they'd be a good fit for the role. A clear job description minimises admin on both sides. Similarly, it pays to carefully consider your method of application. Instead of asking candidates to apply via Seek or email, you could get creative. It could be as simple as scanning a QR code on a poster and following the prompts. 6. Create a supportive culture As businesses adjust to the new way of operating, front-of-house retail and hospitality workers are having to bear the brunt of some of the most difficult and contentious adjustments. This means employers need to be more supportive and understanding than ever. With the introduction of masks, mandatory check-ins and vaccination mandates, many workers now need to be rule enforcers. This is where it’s important that they feel confident in holding their ground. After all, job satisfaction can only be gained from feelings of support, respect and value. 7. Optimise your current team Labour shortages threaten to stunt business growth. Merchants are left with little choice but to overwork themselves and their current employees, or reduce their ability to meet customer needs. One way to avoid curbing business growth in the face of a labour shortage is to optimise your current workforce through the introduction of clever technology that automates time consuming tasks and streamlines your most critical functions. One tool your staff use every day is your EFTPOS Terminal, so it needs to be user-friendly. Zeller Terminal is designed for swift transactions, enabling your staff to take payment from a customer in just a few seconds. Each piece of functionality — from refunds, to MOTO payments and surcharging — has been purposefully designed to be as simple to use as possible. As a business owner, your staff are your most valuable asset. If you can ensure your experienced workers feel satisfied, supported, empowered and valued, you're more likely to retain them. And, by embracing new technologies, you can take some of the administrative burden off your team — giving them the time and energy to tackle the more important tasks. Now that you’re aware of all the ways you can combat the labour shortage and maximise the potential of the holiday season ahead, it’s time to optimise every other aspect of your business for future growth. Sign up to the Zeller Business Blog to cash in on valuable insights sent straight to your inbox.