- Case Studies

Mother Mary Shares Words of Wisdom on Choosing Zeller over Westpac

Learn how Zeller can support your business.

Mother Mary is a one-woman baking powerhouse based an hour south of Melbourne on the Mornington Peninsula, cooking up cakes, crackers, biscuits, granola and more for her loyal fans and stockists.

Wherever possible, Mother Mary Bakes opts for locally-grown produce and organic ingredients in all her products, delivering them across the peninsula several times a week. In addition to her mouth watering baked goods, Mother Mary also runs semi-regular baking workshops, often with a focus on the fine art of sourdough.

We sat down with the founder of Mother Mary to learn about her business and why she switched her business banking from Westpac to Zeller.

What’s the story behind Mother Mary?

“Well, I should probably start by saying that my name is actually Hannah, not Mary. It was my grandmother Mary who got me into baking, and the business is named after her. When I was a teenager, nan and I would bake up all her old family recipes that had been handed down from her mother, and that’s when I fell in love with baking.

I started the business as a bit of a hobby-slash-side-hustle with my cousin who also loves baking, and the thing that connects us both – as well as being great friends – is our grandmother, so when the name was first suggested, it just felt right.

After several successful stalls at local markets, I decided to make Mother Mary my full time business. My cousin lives too far away for it to be a full time thing for her, but she’s always more than happy to do some taste-testing whenever she visits.”

How did you set up the business?

“Once we had our brand name in place, we got an ABN and headed off to our first market stall with a car packed full of goodies we’d baked in mum’s kitchen, a fold out trestle table and a metal cash box, thinking everyone would be paying in cash – but that didn’t last long at all.

We quickly realised that less than half of our customers were carrying cash, but luckily most were happy to pay into my personal Westpac account using PayId on their phone. It wasn’t ideal, but it was workable temporarily. We noticed many other stallholders were using mobile EFTPOS readers, so we bought one of those pretty much straight away, although it wasn’t a Zeller one.

It only took a few stalls for me to realise mum’s kitchen wasn’t going to be big enough if I wanted to make Mother Mary a full-time gig, and mum very kindly offered me the use of a shed at her place, suggesting I could turn it into a dedicated bakery. My partner is an electrician and lots of his mates are tradies too, so it wasn’t long until we’d connected power to the shed, added plumbing, plastered and painted the place, and fitted it out with ovens, benches, fridges and other equipment from Facebook Marketplace.

So in a few months, the business grew from mum’s kitchen and a cash tin to a purpose-built bakery with a website and a way to take card payments. It stopped feeling like a hobby and instead felt like a proper business – it was very exciting.

A few months later, tax time rolled around, so I connected with a friend-of-a-friend who’s an accountant. They were very encouraging about the business in general, but not overly delighted about the fact the business finances were mixed in with my personal finances.”

You mentioned Westpac. What made you switch to Zeller?

“Well, despite my accountant not being thrilled with it, I continued running the money side of the business via my personal Westpac account for a couple more years because…I guess I just didn’t have the time or energy to go into the bank and set up a business bank account. I know that sounds silly, but when you’re running a small business, standing in line at the bank with a million pieces of paperwork just isn’t appealing…so I put it off.

Then a couple of years ago, a friend showed me her Zeller Account on her phone. I noticed there was money in the account, and I asked her which bank she was with. I thought the app was somehow showing her balance from her bank account. She explained that Zeller has its own transaction account built in, so you literally don’t need a traditional business bank account.

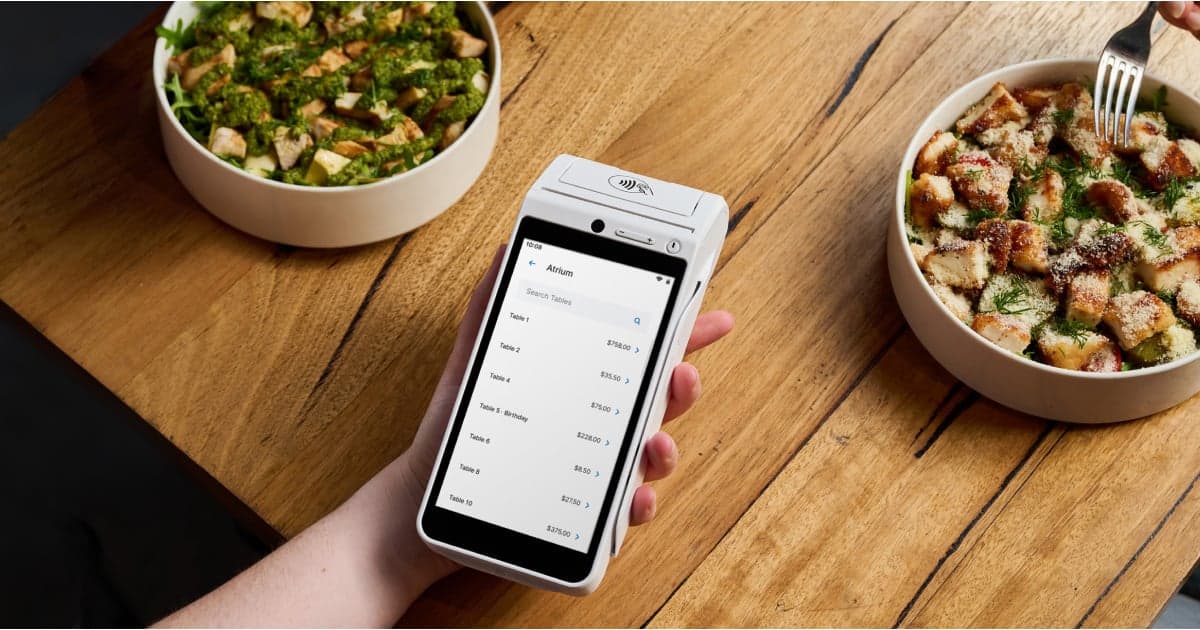

Then she showed me her Zeller Terminal, which was much better looking than my old EFTPOS machine, and I thought, ok, this seems like a better solution, and it will make my accountant happy having things separate, so I downloaded the Zeller App then and there.”

What’s your favourite part of the Zeller product suite?

“I love that it’s an all-in-one solution, so I don’t need to be switching between multiple apps or tabs – it’s all in one place.

As far as what’s my favourite part, well, I guess I switched to Zeller for the transaction account originally, then when I got the Zeller Terminal, I realised the transaction fees are a fair bit lower than what I’d had, and that was nice too.

Another good part is the Zeller Debit Card. It means whenever I buy ingredients or petrol for the delivery van or anything else for the business, I just use that card and it’s immediately visible in my Zeller account, so it makes tracking my spending very easy.

Virtual Terminal is also brilliant for taking orders over the phone, and I can send out payment links and invoices from the dashboard. Plus the business earns interest on its savings with the Zeller Savings Account.

When you add it all together, it’s an all-in-one solution that does absolutely everything I could want it to and more. It’s so much better than what I had before.”

What advice would you give to other small business owners considering switching?

“Well, one thing I can say is that I absolutely detest paperwork, so the fact I could sign up for a Zeller account without having to visit a bank branch or fill out any painful forms was a big plus.

It was very easy to switch, it made my accountant happy, the tech is excellent…so my advice would be to just do it. When you run a small business, time is money, so I understand people thinking it’s easier to just stick with what you’ve got. But with the cheaper fees, the debit card, savings account, virtual terminal, invoices and everything else built into an all-in-one solution, it’s a no-brainer.”