How your business can benefit from online invoices

If your business is still printing paper invoices or sending PDFs via email, you're probably losing time and money to an outdated process. These days, there's a way more efficient way to create, send, and get invoices paid – thanks to online invoicing software. Instead of generating invoices from Word templates, saving them, then printing or emailing them manually, online invoices centralises everything into one platform that you can access anywhere you've got an internet connection. Not only does this speed up the time it takes to generate and send online invoices, but it also helps them get paid faster, thanks to integrated payment processing that lets customers pay online with their credit card.

Professional-looking online invoices created and sent in minutes, anywhere

Zeller Invoices gives you clean, professional layouts that just need your business and payment details dropped in. The invoicing app has an intuitive interface that makes it easy to add your business address, company name, ABN, contact info, client details, product or service descriptions, payment terms, and any extra notes. You can also customise templates to match your brand – change the style, tweak the colour scheme, and drop in your business logo. Zeller is designed for Australian businesses, with AUD and GST fields built in. Plus, totals are automatically calculated based on what you enter, cutting down on time and mistakes.

Invoicing software that gets you paid faster

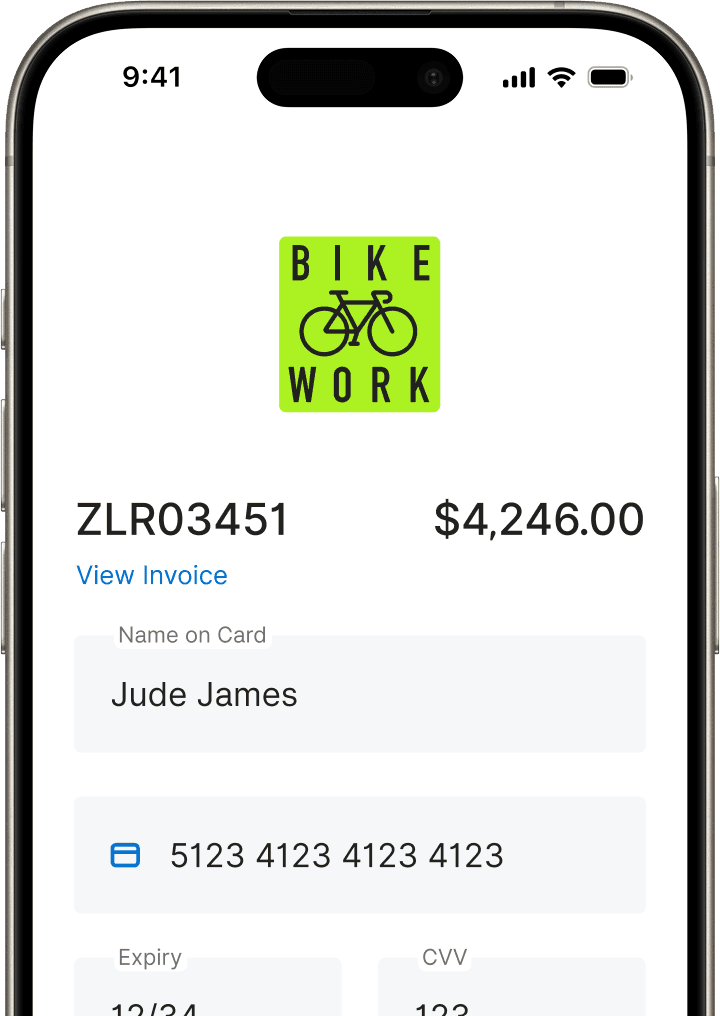

Zeller’s free invoice app, Zeller Invoices, lets you create accurate online invoices in less time. Since calculations are handled automatically, you're less likely to make mistakes that lead to back-and-forths with clients – which delays payment and chips away at trust. You can send online invoices straight from the platform via email or SMS, so there's no need to download and attach a PDF that might get lost or overlooked. The built-in contact directory saves client info for next time, speeding things up even more. And with SMS delivery, clients can view and pay invoices right from their phone. Since Zeller’s platform accepts credit card payments online, it's easier for customers to pay, and much faster for you to get paid. That means a shorter gap between finishing a job and seeing the cash in your account – which is a big win for your cash flow.

Invoice from anywhere with a powerful invoicing app

Zeller Invoices are available in the Zeller App, giving you full invoicing power wherever your business takes you. Whether you're on a job site, meeting with a client or on the go, you can create, send, and track invoices with this free invoice app – right from your phone. That means no more waiting to get back to the office to handle admin. You can instantly send an invoice as soon as the work’s done, speeding up the payment process and keeping your cash flow moving. The invoice app also lets you access your contact directory, view invoice statuses, send reminders, and take payments – all from one simple dashboard in your pocket. We think it’s the best app for invoices in Australia.

Integrate your invoices into your financial ecosystem

When you choose Zeller Invoices, not only do you gain access to the newest and best online invoicing technology, you also benefit from Zeller’s wider ecosystem of financial services. By settling money into a Zeller Transaction Account (rather than a third party business bank account) you will enjoy nightly access to your funds (365 days a year), as soon as your invoices are paid with Zeller’s online invoicing platform. Then, you can put your funds to use with a Zeller's business debit cards or with Zeller Corporate Cards. From Zeller’s easy-to-use online dashboard, you will be able to track every cent: which invoices have been paid or not, your cash balance graphed over time, your spending, and more. Zeller Contact Directory lets you view the payment history of each client which can help with reconciliation, or simply with identifying regular or high-value clients. By keeping your invoicing, financial management, and business spending in one integrated platform, not only will you have better control and visibility over your cash position, but it will also greatly simplify reconciliation.

Pricing for Zeller’s online invoice software

With Zeller’s online invoicing platform, there’s no limit to the number of invoices you can send for free, no monthly fees, and no lock-in contracts. You only pay a transaction fee (1.7% + 25 cents for domestic cards) when a customer pays online through Zeller. Plus, there are no settlement fees; funds are available nightly in your Zeller Business Transaction Account or as soon as the next day in a third-party bank account. While free invoice generators suit one-off invoicing, businesses requiring consistent invoicing may benefit from more advanced options with a payment gateway integration such as Zeller’s.