- Product Updates

The 2025 Tally Up: What Zeller Delivered This Year

More than 100,000 of you are now using Zeller to run your business finances. Your support — and feedback — is what drives every feature and product we build. Here’s a look at everything we created for you in 2025.

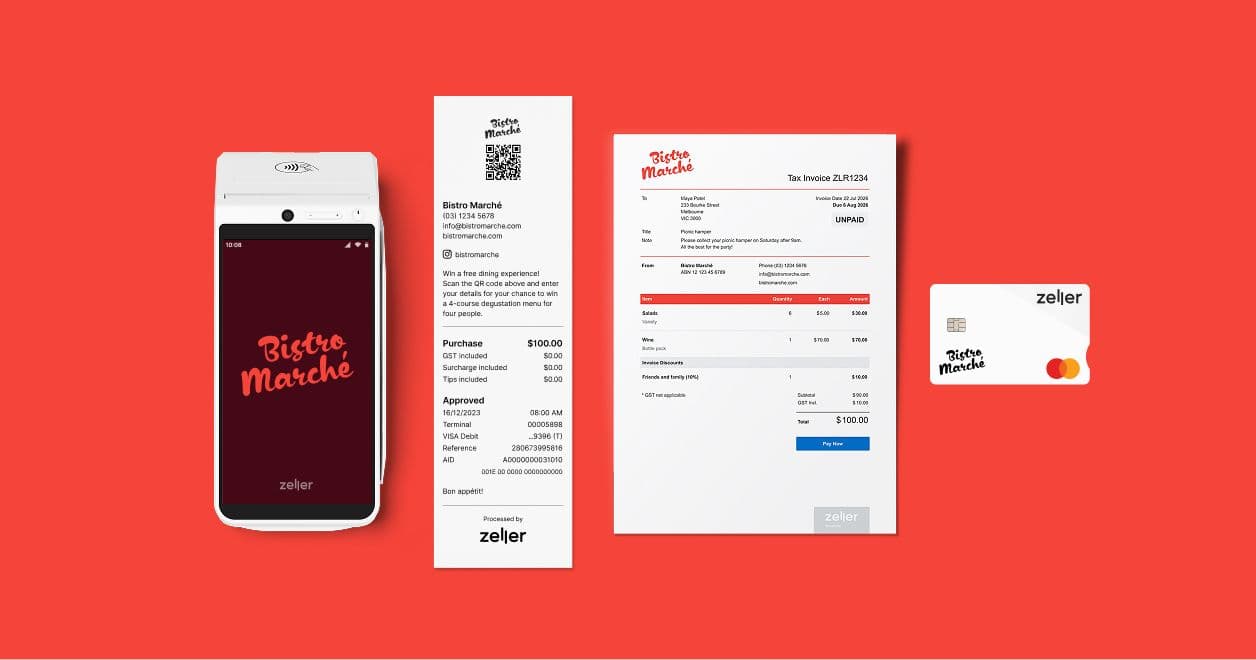

1. Personalised Zeller Debit and Corporate Cards

At Zeller, we work to bring your brand to life across every customer touchpoint. From the screen on your terminal to the colours of your invoices, our goal is to help you customise every payment experience so it reflects your business. This year, we expanded that personalisation to Zeller Debit and Corporate Cards, giving you the ability to add a custom logo and label to your physical cards. As well as reinforcing your brand’s professionalism, a personalised card makes it even easier to manage business finances by quickly being able to distinguish business from personal spending. Learn more.

2. China UnionPay acceptance

This year, China was Australia’s largest tourism spender, contributing $9.2 billion to the local economy — and that’s not counting the thousands of Chinese nationals living and studying locally. That’s why we made it a priority to help Australian businesses better serve this growing customer base by accepting their preferred payment method: UnionPay. With more than 200 million cardholders worldwide, UnionPay unlocks new opportunities for Zeller merchants across in-person payments on Zeller Terminal, as well as invoices, Tap to Pay, and payment links. Plus, it comes with the same simple, low, flat 1.4% transaction fee as all other card payments accepted with Zeller. Learn more.

3. Scheduled one-time and recurring transfers from your Zeller Transaction Account

From paying suppliers, employee wages, and rent to transferring funds to your tax or savings accounts — running a business means constantly moving money. This year we rolled out one of your most-requested features: the ability to schedule one-time or recurring fund transfers. You can now send funds at a future date and time — right down to the quarter hour. Set transfers to occur once or on a recurring daily, weekly, or monthly schedule, and choose exactly when that schedule ends. And if plans change, you can update or cancel a schedule at any time. You can schedule transfers from Zeller Dashboard or Zeller App. Learn more.

4. Oracle and Linkly-integrated POS enhancements

For businesses using a point-of-sale system integrated via Linkly or Oracle Simphony, we released two major updates this year designed to make customer service even more seamless. The first: accepting over-the-phone payments. You can now manually enter card details on your Zeller Terminal when a sale is pushed from your POS — no physical card needed. Learn more.

The second: issuing refunds that aren’t linked to a previous POS transaction. This update allows you to push an unmatched refund from your Linkly- or Oracle-integrated POS to your Zeller Terminal, which then processes the refund directly back to the customer’s card. Learn more.

5. Bill at Table on Zeller Terminal

When we built Pay at Table in 2023, it was our first step toward solving a long-standing challenge for table-service restaurants: the disconnect between finalising the bill at the counter and accepting payment at the table. This year, we introduced its even more powerful successor: Bill at Table. Restaurants can now present diners with itemised bills directly on Zeller Terminal’s large digital screen and instantly accept payment instantly tableside, without locking up the POS. It’s a game changer for customers and waitstaff alike. Diners can select which items they want to pay for, or they can split the bill by percentage — while staff spend less time running between the POS and the table and more time serving guests. Learn more.

6. Smarter item management with Zeller Invoices

When we saw how much merchants were loving the ability to use item attributes, discounts, and modifiers in Zeller POS Lite, we made it a priority to bring that same functionality to Zeller Invoices. You can now add any attributes (such as size or colour) or modifiers (like customisations) as well as discounts from your item library directly to your invoices. Learn more.

We also introduced the ability to add service charges to Zeller Invoices, which merchants can use if they apply weekend or public holiday surcharges, delivery fees, or packaging costs. And to make invoicing even more affordable, we added the option to pass on the invoice processing fee as a surcharge. Learn more.

7. Invoicing on Zeller App

With more business owners running their operations from their smartphones, the ability to send invoices on Zeller App was one of our most-requested features. We’re continually enhancing the app to ensure it offers the same powerful functionality as Zeller Dashboard, and this year we delivered on that promise. You can now create, send, manage, and track invoices directly from your iPhone or Android smartphone. For mobile businesses and tradies, this means you can send an invoice the moment a job is done — helping customers pay faster and keeping your cash flow moving. Learn more.

8. Zeller for Startups

Inspired by the experience of our own founders — who had to navigate the outdated business-banking landscape while building Zeller — we set out to create a free, purpose-built solution that gives new founders every financial tool they need to start and scale. This year, we launched Zeller for Startups: a solution designed for founders, by founders, giving early-stage businesses greater control and visibility over their finances: from invoicing to transaction and high-interest accounts, spending cards, expense management, and more. Learn more.

9. Zeller Developer Suite

One of the most exciting launches of the year came to the aid of enterprise and multi-location businesses, with Zeller Developer Suite — a developer-focused payments platform designed specifically for complex, high-volume organisations. This enterprise-grade platform brings together a comprehensive suite of software development kits (SDKs) and application programming interfaces (APIs), enabling developers and organisations to seamlessly integrate Zeller’s secure payments stack into their own POS software, kiosks, mobile apps, and websites.

10. Enhanced funtionality with Zeller POS Lite

This year, we continued to expand the functionality of Zeller POS Lite, giving merchants even more flexibility to tailor it to their business needs. While card payments remain the preferred method for most Australians, we introduced the ability to record cash sales directly in Zeller POS Lite — whether you’re using it on Zeller Terminal or in Zeller App. Learn more.

We also made it easier to recover higher operating costs, such as weekend and public holiday surcharges, delivery fees, or corkage, and introduced the option to apply 100% discounts when offering giveaways or free gifts with purchase. Plus, we rolled out itemised receipts, giving customers a clear breakdown of every item in their order. Learn more.

And so much more…

From expanding our list of POS integrations to redesigning receipts, enabling multi-site management on our app, and refreshing the user interface across Zeller Dashboard, we also shipped hundreds of smaller improvements in 2025 that didn’t make it onto this list.

If there’s something you didn’t see here — but would make your workday easier — we want to hear it. Share your suggestions at feedback@myzeller.com. We’re looking forward to an even more ambitious 2026, with new tools already in the works to help your business thrive.