- Zeller for Startups

The Venture Capital Firms Backing the Next Wave of Australian Startups

Picking the right venture capital (VC) partner can be a game-changer for early-stage founders.

Beyond just cutting a cheque, a great VC brings industry connections, mentorship, and long-term support to help your startup thrive.

In Australia’s vibrant startup ecosystem, there’s a growing roster of Australian VC firms eager to back the next Canva. This guide introduces some of the most prominent and active VC firms for Australian startups and what they offer. We’ll also touch on why choosing the right VC matters, and what founders should consider when navigating startup funding in Australia.

Why choosing the right VC partner matters.

One of the first things you should know about raising funds for your startup is that not all investment is created equal. The right VC will provide more than just capital, they’ll become a true partner in your growth. Early-stage founders should consider:

Stage & cheque size fit: Ensure the VC firm invests at your stage (pre-seed, seed, Series A, etc.) with cheque sizes that meet your needs. For instance, some funds write first cheques as low as a few hundred thousand dollars, while others lead rounds of $10M and more.

Sector focus: Look at the VC’s portfolio and focus areas. A fintech startup may benefit from a fund known for fintech expertise, while a climate tech venture might seek out an impact-focused VC.

Value-add & support: Beyond money, what does the VC offer? Many top firms provide hands-on help with hiring, networking, strategy, and follow-on funding. The ideal investor believes in your vision and can open doors in your industry.

Cultural fit: All things going well, you’ll be working alongside your investors for years. It helps if their values and expectations align with yours. A supportive, founder-friendly ethos can make the tough journey of building a startup a bit less lonely.

Keeping these factors in mind will help you target investors who truly add value and understand your business. Now let’s dive into some of Australia’s top VC firms backing early-stage startups, and what makes each stand out.

Square Peg

Square Peg is one of Australia’s largest VC firms and has made a serious mark by backing some of the country’s biggest startup successes. Founded in 2012, Square Peg invests from pre-seed through Series C stages. They focus broadly on technology companies, with a particular interest in SaaS, fintech, online marketplaces, and enterprise software. This global fund (with teams in Melbourne, Sydney, Tel Aviv and Singapore) often writes a substantial first cheque (around A$2 million on average in seed or Series A rounds) and can continue supporting startups with follow-on capital into later rounds.

Key sectors: SaaS, fintech, online marketplaces, enterprise software

Notable startups: Canva, Airwallex, Zeller

Website: squarepeg.vc

AirTree Ventures

AirTree Ventures is a heavyweight in the Australian VC scene, known for its founder-first approach. AirTree invests primarily in early-stage tech startups (seed, Series A and B), and they’ve raised large funds to back bold Aussie and Kiwi founders. AirTree is willing to write a founder’s first cheque at seed stage (around A$200k) – they even set aside a seed fund for this – and then continue supporting companies all the way through $100M+ growth rounds. In practice, that means AirTree can lead your seed round and still be there with deep pockets at Series C and beyond.

Key sectors: Broad technology, SaaS, fintech, marketplaces, finance, education, health, agriculture

Notable startups: Linktree, Employment Hero, Buildkite, Zepto

Website: airtree.vc

Blackbird Ventures

Blackbird Ventures is often top-of-mind when discussing Aussie startup funding, and for good reason. Blackbird has grown from the new kid on the block in 2012 to managing over A$1 billion across funds by 2022, making it one of Australia’s largest and most active VC firms. Blackbird loves to invest from the very beginning – they’ll back companies at pre-seed, seed or Series A, and continue through growth stages and even to IPO.

In practical terms, Blackbird might invest a small pre-seed cheque (they’ve been known to invest $250k-$1M at seed) and can follow up with multi-million-dollar investments as your company scales (up to $50M in later rounds).

Key sectors: Sector-agnostic, software, marketplaces, fintech, space tech, synthetic biology, cybersecurity, cultured meat

Notable startups: SafetyCulture, Zoox, Culture Amp, Zipline.io, Rocket Lab, Darwinium, Vow

Website: blackbird.vc

Folklore Ventures

Folklore Ventures (formerly known as Tempus Partners) is an early-stage VC firm committed to backing Australian and New Zealand founders “from first cheque to forever”. They aim to be long-term partners, often writing the very first cheque (pre-seed) and continuing to support startups through growth.

Folklore primarily invests at pre-seed, seed, and Series A stages. They don’t mind getting in early, even pre-product or pre-revenue in many cases, and helping founders navigate those early growth steps.

Key sectors: Sector-agnostic, B2B SaaS, AI/analytics, digital health, developer tools, robotics, cloud infrastructure, quantum computing

Notable startups: Sajari, UpGuard, Harrison.ai, Propeller Aero, Culture Amp

Website: folklore.vc

Tidal Ventures

Tidal Ventures is a newer VC making waves in the seed-stage arena. Headquartered in Sydney with an outpost in New York, Tidal brands itself as “Seed First, Founder First, Product First, Head First”. They specialise in leading seed rounds and early Series A investments, frequently serving as the first institutional investor a startup secures.

Tidal typically writes initial seed cheques ranging from around A$500k to A$1.5M, enabling startups to get off the ground with meaningful early capital. Beyond this initial investment, Tidal maintains the capacity to support its portfolio companies through larger follow-on investments – potentially exceeding A$8M – in subsequent Series A and Series B rounds, underscoring their commitment to long-term partnership and growth.

Key sectors: Software, tech-driven businesses, B2B, consumer tech, fintech, SaaS, enterprise software, API-based startups

Notable startups: FrankieOne, Shippit, Search.io

Website: tidalvc.com

Giant Leap

If your startup has a mission to change the world for the better, Giant Leap is a VC firm you should know about. Launched in 2016, Giant Leap is Australia’s first venture capital fund 100% dedicated to investing in impact startups. That means they back companies that deliver measurable social or environmental benefits alongside financial returns.

Giant Leap typically invests in early-stage rounds (seed and Series A), often taking a minority stake in purpose-driven tech ventures. By 2021, Giant Leap had invested in over 30 impact companies, showing that doing good and high growth can go hand in hand.

Key sectors: Climate tech, renewable energy, sustainable materials, circular economy, digital health, mental health, wellness, edtech, worktech, diversity and inclusion solutions

Notable startups: Sendle, Who Gives A Crap

Website: giantleap.com.au

Glitch Capital

One of the most recent yet high profile entrants onto the Australian investment landscape is Glitch Capital, which is the first 'founders fund' based in the Australian region. Glitch Capital is bringing together some of the best local entrepreneurs to help build the next generation of global technology companies.

The team founded Glitch around the thesis that it recognises that building a company is hard, chaotic and lonely, yet having investors who have shared experiences can help entrepreneurs navigate the journey. Glitch is comprised of an experienced team who have been entrepreneurs themselves, who aim to share their obsession with building the tech companies of tomorrow, as well as a strong belief in curiosity, humility and skin in the game.

Glitch aims to be the preferred investment partner for local founders, helping to navigate the imperfect process of scaling high growth companies. The company has raised over $50m from over 15 unicorn founders and 50 operators that are building companies alongside founders.

Glitch invests ~$1-3m from Seed to Series B alongside other VCs in companies who have found product-market fit and want to scale globally.

Key sectors: General technology, vertical software, AI, fintech

Website: glitchcap.com

Set yourself up for fundraising success.

The Australian VC landscape has grown and matured significantly over the past decade, so whether you’re building a fintech app, a climate tech solution or something never seen before, there’s likely a firm (or several) with the experience to help you navigate growth. But once you secure that all important term sheet, it’s crucial to manage your funding wisely. This is where tools like Zeller for Startups come in.

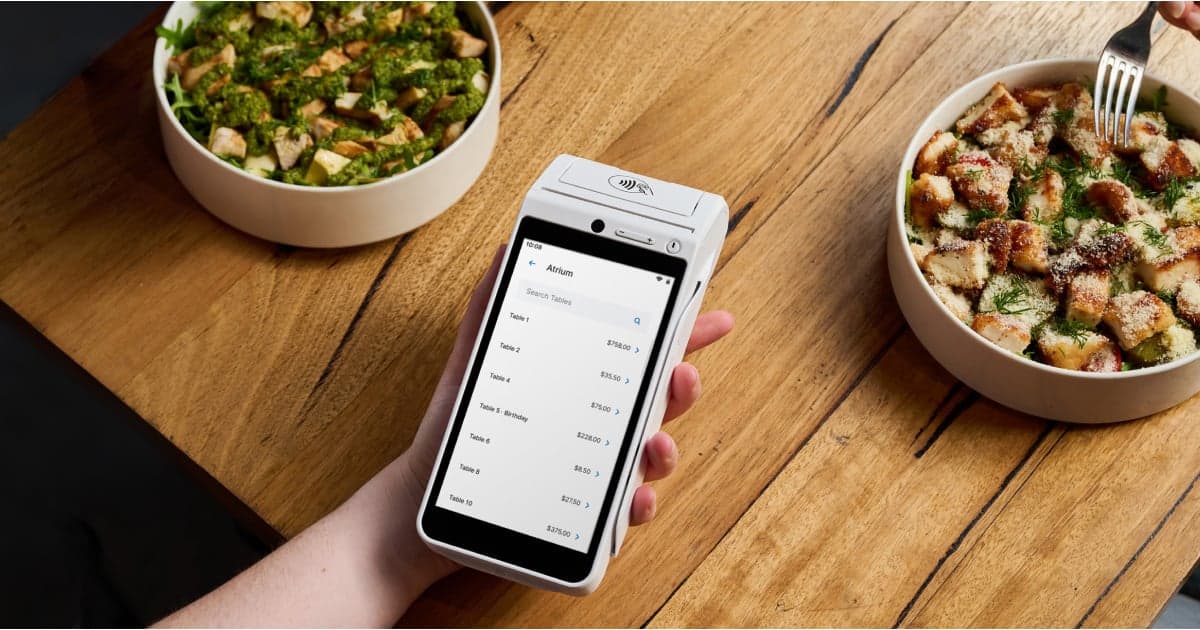

As Australia’s first all-in-one financial platform for founders, Zeller for Startups can help you handle your new funds – with fee-free business transaction accounts, high-interest savings, and smart debit cards for easy expense management – so you can focus on growth.

By picking the right investors and staying on top of your finances, you’ll be well on your way to turning your startup vision into reality.