- Case Studies

How Awaken Pilates and Yoga Keeps Retail Sales Flowing

Learn how Zeller can support your business.

First opened in 2022, Awaken Pilates and Yoga is a boutique fitness business that has already grown to three locations across Perth’s northern corridor – Yanchep, Ashby, and Mindarie. Founded by husband and wife duo Matthew and Gemma Taylor, the studios offer a mix of reformer Pilates, mat Pilates, yoga, meditation, and infrared sauna.

We sat down with Matthew to learn the story behind the business and how Zeller has been able to play a small but positive role in its impressive growth.

Building a boutique fitness community.

“My wife and I have been involved in the fitness industry for almost 20 years now,” Matthew explains. “About three years ago, we started Awaken, a chain of boutique Pilates studios. We do everything from reformer Pilates to yoga and meditation, so we’re a fitness and wellbeing business.”

Beyond instructor-led classes, Awaken offers 24/7 access so members can train independently. “We’re one of only a few in the country who do it,” Matthew says. “People get a 24/7 tag just like a gym. We’ve got screens set up where they can do on-demand classes, and the sauna is 24/7 as well.”

At its core, Awaken aims to help members build a stronger connection with themselves, physically and mentally. “What we’re trying to achieve with the members is getting them to fall in love with fitness and focus on themselves,” Matthew says. “We’ve seen over the years how powerful it can be to have a positive relationship with yourself from a wellbeing perspective.”

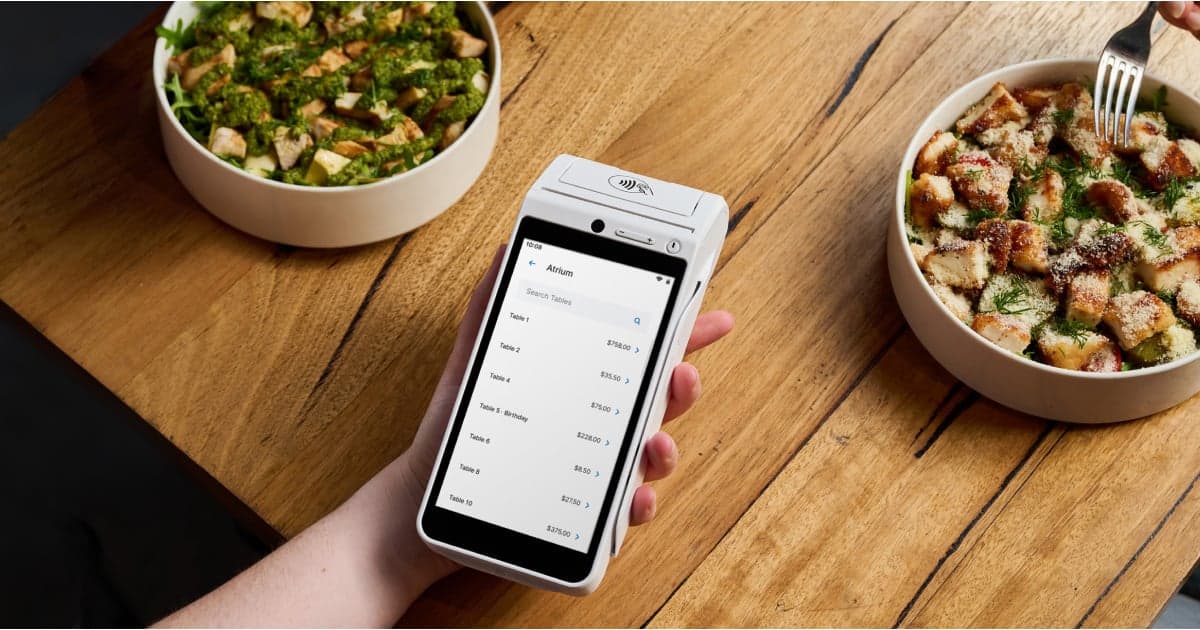

Making retail sales effortless with Zeller POS Lite.

While most of Awaken’s revenue comes from membership fees billed weekly through their CRM system, retail sales (like grippy socks, apparel and protein powder) also provide an important secondary revenue stream to the business. Managing these sales efficiently, however, was a little tricky – until Awaken introduced Zeller POS Lite across all three studios.

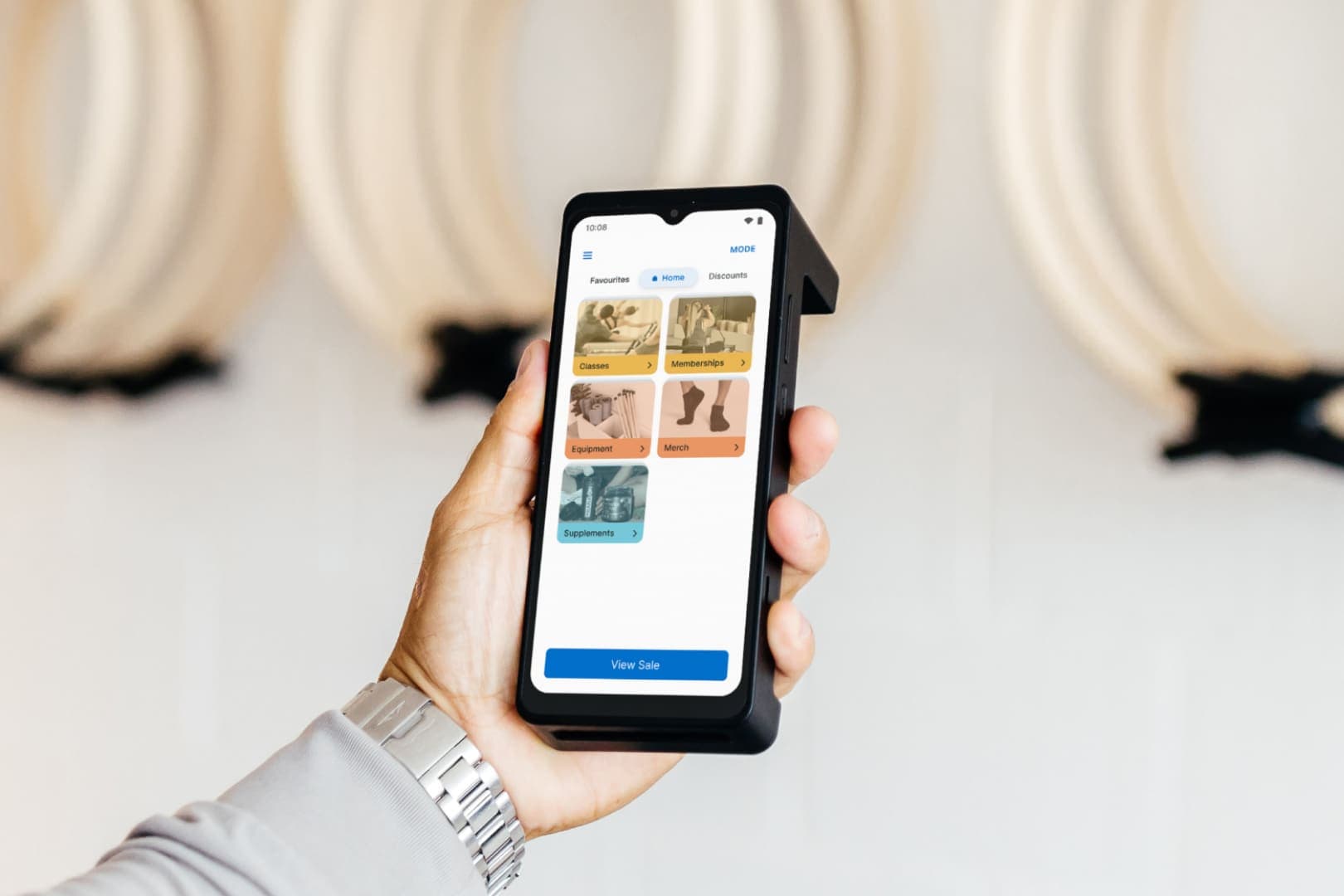

“A lot of our instructors are contractors who work across different studios.” Matthew explains. “So we needed a system that was super intuitive with no real training involved. Zeller POS Lite couldn’t be simpler. When someone wants to buy socks or some protein, the instructor just clicks on an image and it comes up straight away on the machine. They don’t have to work the computer or any sort of complicated point-of-sale system.”

Stretching sales while reducing admin.

The simplified sales process has made instructors more confident in processing transactions, leading to an increase in retail purchases.

“Having that visual point-of-sale system on the EFTPOS machine itself just makes it a lot easier,” Matthew says. “Because it’s so easy to use, we find that the instructors are much more confident in selling the product for us instead of avoiding it because they don’t know how to use the machine or they don’t know the pricing of the product.”

When the end of the month draws near, Zeller POS Lite’s in-built reporting function proves very useful.

“We utilise the reporting function to gain a deeper insight into how our retail products are performing, what products are resonating with our members and where to better invest in our product offering for the future at each studio. This allows us to maximise the efficiency of our product management and also helps drive our marketing with relation to our retail products,” explains Matthew.

Switching from Commbank to Zeller.

Before switching to Zeller, Awaken used Commonwealth Bank terminals, but the fees and complex pricing structure quickly became a frustration.

“I would never set up another business with a traditional bank again, because you’re paying a monthly fee and then all of your costs on top of that when you go above a certain amount. It actually is just a lot easier to have something like Zeller, which takes a little percentage on each transaction and has a nice, easy portal to navigate.”

Beyond transaction fees, Matthew also found the process of upgrading or canceling bank terminals unnecessarily difficult and expensive.

“They make it so hard for you,” he says. “You’ve got to pay for someone to collect it and all this sort of stuff. There’s fees and charges all the way through the journey.”

A flexible, scalable solution.

With transparent pricing, ease of use and a seamless experience for both instructors and members, Zeller POS Lite has helped Awaken eliminate banking frustrations while streamlining their operations.

“We’ve got it sectioned into three categories – merchandise, casual sales, and supplements,” Matthew says. “It’s so simple for the instructors to navigate that, it works perfectly.”

By choosing Zeller POS Lite, Awaken Pilates and Yoga has found a flexible solution that strikes the perfect balance between simplifying sales, empowering staff, and supporting business growth.