Your exclusive Zeller EFTPOS offer.

Free sign up

No monthly fees

Lower transaction fees

Pay $0 on transactions with Tap to Pay.

Get cash back on transaction fees paid for your first $3,000 of payments.

Terms apply.

Lower fees

One low, flat transaction fee for all cards, including American Express.

Faster settlement

Enjoy fast nightly settlement to your Zeller Account, or sweep to any business bank account.

No hardware needed

Accept contactless payments with just your smartphone. No terminal required.

Zeller for ALIBI members.

An exclusive offer negotiated for all ALIBI members.

Low 1.3% transaction fee for in-person payments (usually 1.4%).

Priority support, implementation and training.

Start selling today using Tap to Pay with Zeller App, enabled on your own phone.

Built-in surcharging for zero-cost EFTPOS.

Start selling today with Tap to Pay.

Accept contactless card and digital wallet payments using your smartphone and Tap to Pay with Zeller App.

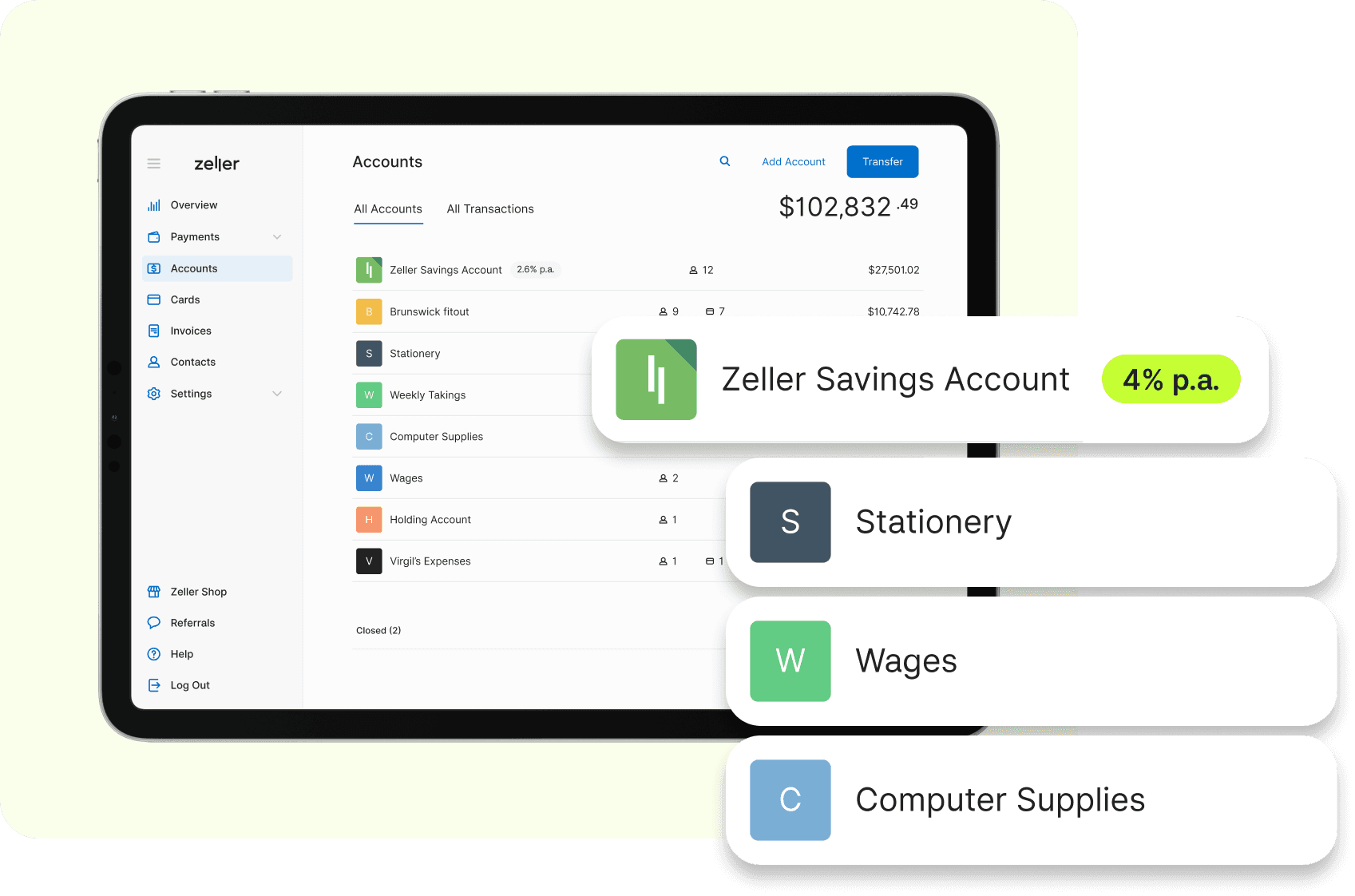

Grow your savings faster.

Earn a better interest rate with a Zeller Savings Account.

Activate your savings account instantly – no forms required.

Earn a better interest rate than with a big-4 bank.

Access and withdraw funds whenever you need them.

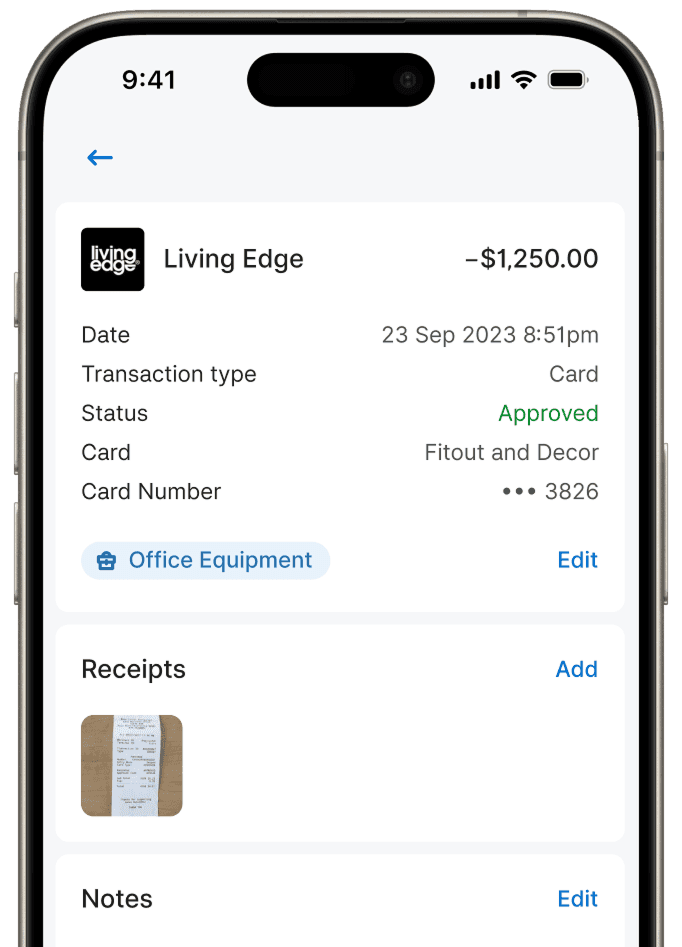

Take control of every dollar.

Categorise transactions, link contacts, and attach notes or receipts to streamline end-of-month reconciliation and expense reporting. Plus, add spend controls to ensure budgets are never exceeded

You’ll save when you switch to Zeller.

1.3%

In-person payments

For all cards, including American Express with no monthly fees or lock-in contracts.

$0

Hardware costs

Accept payments from your smartphone using Tap to Pay with Zeller App.

Loved by Australian businesses.

I’m SO obsessed with taking payments on my phone. I don’t even use my Terminal anymore. I don't have to worry about charging another device. Plus, there were a couple of times when I put my Terminal in my bag and took it home, and then forgot to bring it the next day. But... you never forget your phone!

Level 10, The Studio

Take advantage of this exclusive offer today.

Free sign up

No monthly fees

Lower transaction fees