Too often for Australia’s 2.6 million actively trading small businesses, sending an invoice means waiting weeks to see the money.

In fact, research has shown that, on average, Australian SMEs are paid 6.4 days later than their payment terms, which is estimated to cost owners $1.1 billion in lost working capital every year. That delay makes it harder to pay staff or cover bills, while also reducing interest earned and increasing opportunity cost.

Put simply, getting paid late is bad for your business – so what can you do to take a greater level of control over your cash flow? Read on to find out.

Paper and PDF invoices persist – but why?

Australians have long embraced the speed, accountability, security, and transparency that electronic payments offer, with card payments making up 76 per cent of all transactions. In striking contrast, a recent report estimated that around 90% of SMEs are still sending paper-based or PDF invoices.

With digital payments so deeply entrenched, why are Aussie SMEs still sending invoices that force their customers into the arduous process of opening a banking app and copy‑pasting BSBs and account numbers? It’s a fair question – especially when online invoicing solutions are far more time-efficient and result in much faster payment.

How much faster, you ask? The numbers below tell a clear story.

Invoices payable by card are paid

faster

on average.

of invoices are paid within 24 hours when customers can pay by card.

Invoices sent via SMS are paid

faster

than those sent by email.

100,000+ invoices. Four key insights.

Zeller recently analysed more than 100,000 invoices sent and paid via Zeller Invoices. The data clearly demonstrates that online invoicing not only accelerates payments but also reveals important insights around industries, payment methods, delivery channels, and payment terms. This report dives into these insights, providing a guidebook for how you can immediately improve your business cash flow.

Insight 1

Invoice payment times vary across industries.

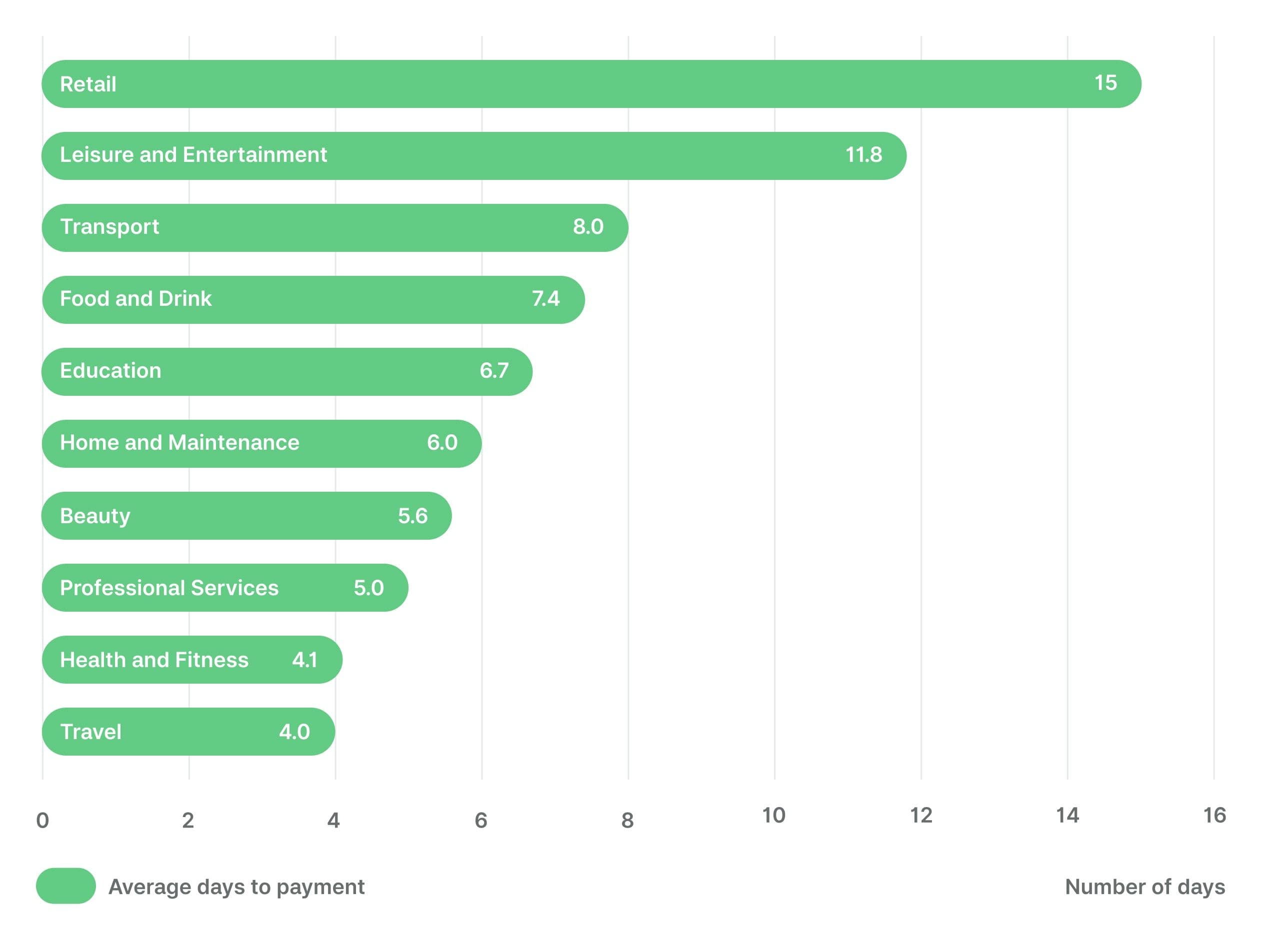

When it comes to invoice payment speed, not all industries are created equal. Zeller’s data shows that on average, invoices are paid in 7.14 days, regardless of sector. Industries such as Retail, Leisure & Entertainment, Transport, and Hospitality tend to be the slowest – on average taking longer than a week for invoices to be paid. In contrast, sectors like Travel, Health & Fitness, Professional Services, and Beauty benefit from faster invoice payments, below the 7-day Australian average.

Average invoice payment times by industry

Some pay faster. Retail and entertainment businesses face the slowest turnaround, while travel and fitness services get paid much faster.

Why the difference? Payment delays can depend on industry norms and client expectations. For example, retail suppliers often wait on store owners to reconcile accounts, whereas a beauty therapist or consultant may be paid immediately after the appointment. Knowing where your industry stands helps set your expectations and plan your cash flow. If you operate in a typically slow-paying sector, it’s wise to be proactive about speeding up payments (as we’ll explore in the following sections). And if you’re in a faster-paying field, there may still be room to tighten the turnaround and get paid even sooner.

Practical tips

Know your benchmark

Research typical invoice payment timelines in your industry. If your invoices consistently lag behind your industry’s norm, it may be time to follow up more assertively.

Consider deposits and discounts

If you’re in a slow-paying industry, consider requiring deposits or partial upfront payments on large jobs to protect your cash flow, as well as discounts for prompt invoice payment.

Apply best practices universally

Regardless of industry, strategies like offering easy payment options and fast invoice delivery can help beat the averages and get your invoices paid faster than your competitors'.

We’ve cut the time we spend invoicing in half since switching to Zeller Invoices, and we’re getting paid twice as fast. It’s been a game-changer for our business and our cash flow.

Jake Nolan, Woolcott St

Insight 2

Invoices payable by card are paid 7 times faster.

One of the report’s most striking findings is the impact on payment timing by the payment methods available to settle an invoice. Invoices that offer customers an online credit card payment option get paid dramatically faster – on average 7 times faster than invoices that only offer payment via manual bank transfer. In fact, when customers can click a secure link and pay by card, invoices are settled in just about 2.4 days on average, versus 14.5 days when only a bank transfer is offered.

This trend holds across every sector, though the degree varies. For example, in the Beauty industry, card payments got invoices paid a whopping 15 times faster, versus about 3 times faster in Retail (which is still a huge improvement). Travel businesses saw 9x faster payments with card, Food & Drink about 8.4x, and even traditionally slower sectors like Transport saw over 4x improvement. The bottom line is that, no matter your field, offering customers the choice to pay invoices by credit or debit card greatly accelerates your cash flow.

Why does card payment make such a difference? It comes down to convenience and immediacy. Paying an invoice by card is frictionless for the customer – it’s just a few clicks with no need to open a banking app or remember a BSB and account number. Customers can even pay on credit (which means they don’t need cash on hand at that moment) and can potentially earn reward points for doing so. The process is faster and all in one place, especially with digital wallets like Apple Pay or Google Pay allowing for one-tap checkouts. In contrast, bank transfers introduce more steps and greater friction (opening a separate app, typing out amounts and references, ensuring funds are available), which means invoices tend to sit unpaid longer.

Average days paid when clients are offered the option to pay an invoice online via credit card.

Average days paid when clients are only offered the option to pay an invoice via bank transfer.

The data illustrates this clearly. When an invoice includes a card payment link, 70% of those invoices are paid within 24 hours of being sent. With bank-transfer-only invoices, however, a mere 28% are paid on the same day – and nearly 40% of these invoices remain unpaid for over a week. That gap can be the difference between having money in your account tomorrow versus chasing customers next month. Enabling instant online payments essentially turns invoices into a quick “checkout” experience for your client, dramatically improving the odds of prompt payment.

Practical tips

Enable “Pay Now” on every invoice

Always include an integrated credit card payment link on your invoices. Using an invoicing solution (like Zeller Invoices) that embeds a card payment gateway lets your customer settle up on the spot, which our data shows will hugely reduce payment times.

Highlight ease of payment

Make sure your clients know they can pay online by card. Consider mentioning it in the invoice note or your email (“Pay instantly by clicking the button”). Emphasise that it’s quick, secure, and they can use their preferred card or mobile wallet for convenience.

Leverage digital wallets

Many customers have cards saved in Apple Pay or Google Pay, which enable one-click payments. Ensure your invoice payment page supports these methods. This removes even more friction and encourages immediate payment while the invoice is fresh in mind.

Invoice from anywhere.

Get paid faster.

Create and send invoices with a tap, completely free with Zeller Invoices.

Insight 3

Invoices sent via SMS are paid 43% faster than those issued via email.

How you deliver an invoice can be almost as important as the options you provide to customers for them to make invoice payment. The data reveals that sending invoices by SMS leads to significantly faster payments than sending them by email. In fact, an invoice sent as an SMS link is paid 43% faster on average than an invoice sent via email. In other words, getting that bill directly into your customer’s phone via text message can shave substantial time off the payment turnaround.

This makes sense when you consider customer behaviour. A text message is typically read within seconds, and it pops up right in front of the client – it’s hard to ignore. By contrast, an emailed invoice might sit unseen in an inbox or be deferred until “later” when the customer is at their desk. Worse, emails can get lost in spam or filtered out, meaning your client might not even see the invoice at all. With SMS, you’re putting the payment link literally in your client’s hand, on the device they check most often. It’s the most visible way to get their attention on a bill.

Another important factor is mobile optimisation. If you send a text with a payment link, you can almost bet the customer will click it on their smartphone – so that invoice needs to be easy to read and pay on a small screen. A clunky or non-mobile-friendly payment page can create friction and delay payment. On the other hand, a smooth mobile checkout (think big buttons, simple form, autofilled details) encourages customers to settle the invoice immediately, perhaps even on the spot while they’re thinking about it. Zeller Invoices automatically recognises which device is being used to, meaning it works flawlessly on both mobile desktop.

Average invoice payment times by delivery method

Can you text me? Sending invoices via SMS leads to faster payment than email alone. Texts are read quickly, and they get results.

Timing is another factor here. The sooner the customer receives the invoice, the sooner you’re likely to get paid. Our data suggests a strong benefit to issuing the invoice as soon as a job is done or a sale is completed, rather than waiting hours or days. For instance, if you finish a service call or deliver goods, sending the invoice before you leave the client’s location can prompt immediate payment (often customers will pay while you’re still there). Prompt invoicing keeps the transaction fresh in the client’s mind and signals professionalism.

Practical tips

Send invoices via SMS for instant visibility

Wherever possible, send your invoice via text message to the client’s phone. It’s more likely to be seen and acted upon right away than an email buried in an inbox. (You can still send an email copy for their records as well, but the SMS will help drive urgency.)

Ensure mobile-friendly payment flows

Use an invoicing tool (like Zeller Invoices) that provides mobile-optimised invoices and payment pages. Test the experience yourself on a phone – the invoice should be easy to open, read, and pay with a few taps. A seamless mobile checkout means the customer has no excuse to “do it later on the computer.”

Invoice immediately after the job

Don’t wait until the end of the day or week to batch-send your invoices. Instead, send them as soon as the work is done, preferably from the job site. Prompt delivery capitalises on the moment your customer is most mindful of the value they received, making them more inclined to pay promptly.

Zeller Invoices makes invoicing quick and easy. I’ve tried other pieces of invoicing software – even ones tailored to my industry – but they just don't have the same features or flexibility.

Kelvin Masendu, KelTech Motors

Insight 4

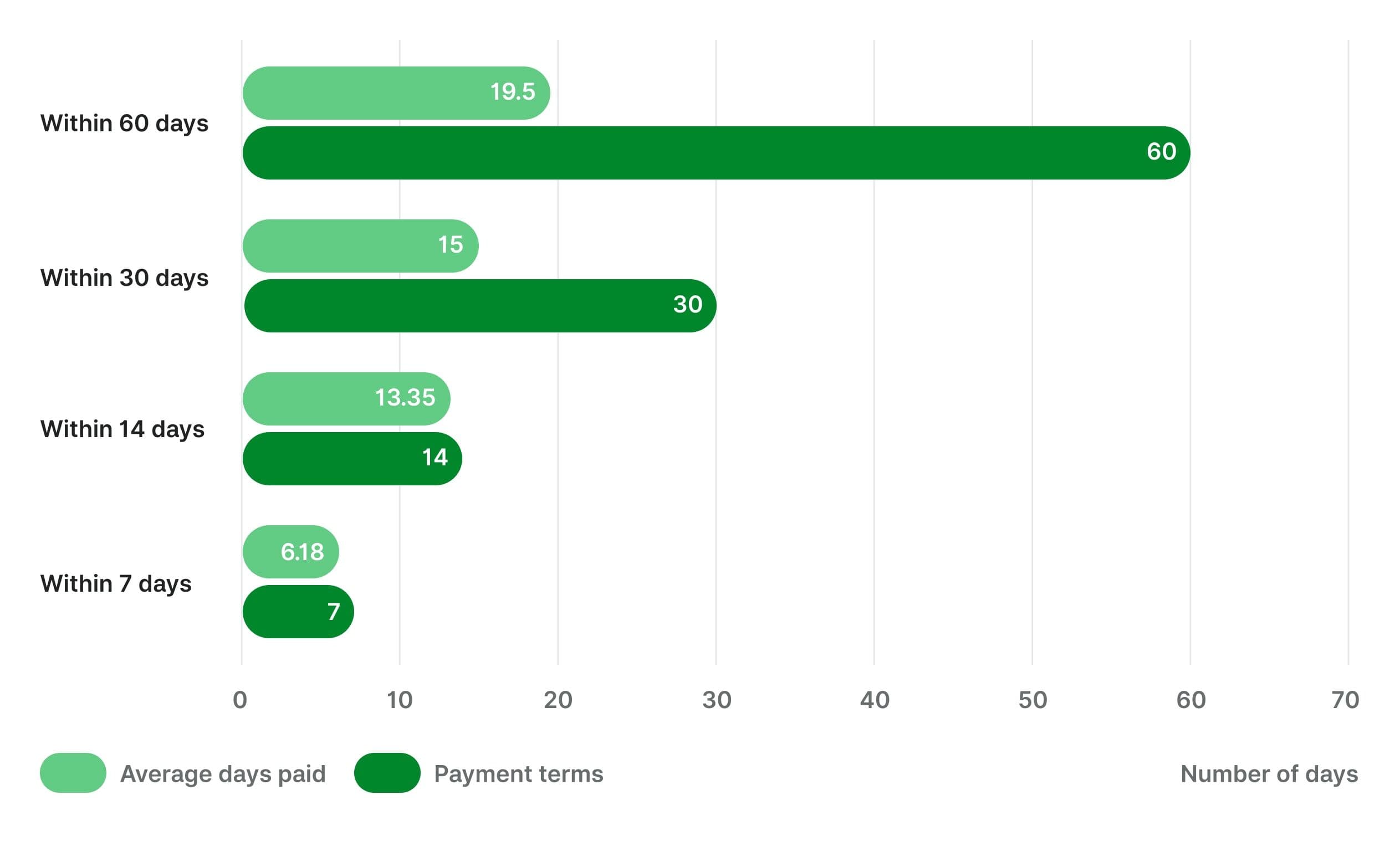

Longer terms don’t necessarily mean slower payment.

It’s common for businesses to offer extended payment terms – such as 30 or 60 days – to valued clients or to entice new business. Intuitively, you might think giving a client two months to pay would result in getting paid closer to that 60-day deadline. Surprisingly, Zeller’s data shows that extending payment terms doesn’t significantly delay when customers actually pay. In other words, a client given 60 days isn’t guaranteed to take 60 days to pay – they often pay much sooner. In fact, invoices with 30-day terms were paid on average in about 15 days, whereas invoices with 60-day terms were paid in under 20 days on average.

What does this mean for you? First, offering extremely long terms (beyond 30 days) may not be necessary in many cases, since clients aren’t likely to fully utilise that extra time. If a customer is going to pay you in about two to three weeks regardless, then giving them two months to pay is more of a courtesy than a requirement, and it could unnecessarily strain your cash flow. Remember that when you extend long payment terms, you’re effectively extending credit to your customer and financing their operations in the meantime. That can leave you footing the bill for expenses (like goods sold or staff wages) while you wait for the money to come in.

Secondly, the fact that longer terms don’t necessarily mean later payments presents an opportunity – you might be able to negotiate shorter terms without upsetting customers, especially if you’ve noticed they typically pay early anyway. For instance, if a client consistently pays your 30-day invoice in two weeks, that’s a signal that you could propose a 14-day term moving forward, formalising what’s already happening in practice. This protects your cash flow with minimal impact on the customer, who has shown they don’t really need the extra time anyway.

Average invoice payment times vs payment terms

Customers rarely wait the full term. Invoices with 30-day terms are typically paid within 15 days. Even 60-day terms average just 20 days.

Of course, some clients will still push right up to the deadline (and a few will be late payers regardless of terms). The key is to know your customers. Use your invoicing data or reports to identify who pays when. You might find some always pay early (or on time), while others chronically drag their feet. You can then manage each accordingly. Perhaps rewarding prompt payers with a small discount for early payment, or enforcing late fees for stragglers, as appropriate.

Practical tips

Set realistic payment terms

Don’t automatically default to the longest allowable term. Consider your own cash needs and the nature of the client relationship. If you have to pay suppliers or staff within 2 weeks, for example, giving a customer 60 days to pay could put you in a bind. Align terms with what your business can afford.

Monitor payment patterns

Keep track of how quickly each client actually pays their invoices. Digital invoicing systems like Zeller Invoices can easily show you this data. If a customer routinely pays well before the due date, that’s good to know. And if others always pay late, you’ll spot it and can act on it (by sending reminders or tightening terms).

Adjust terms when needed

Where appropriate, negotiate shorter terms for clients who consistently pay early. For example, if a client on 30-day terms always pays in 15 days, discuss moving them to net 15 formally. They’re likely to agree, and it reduces your exposure. Conversely, if someone regularly abuses your 30-day terms by paying on day 30 or beyond, you might decide not to offer extended terms to that client in the future.

Want your invoices paid faster?

Over 75% of Zeller Invoices are paid within 24 hours.

Create and send unlimited professional invoices for free, accept secure online payments, and automate reminders – all from your desktop or smartphone. No monthly fees or lock-in contracts.