- Payments & Point of Sale Solutions

- Product Updates

The UK Fintech Revolution: How It's Reshaping Money and How to Navigate It.

The UK Fintech Revolution: How It's Reshaping Money and How to Navigate It.

In 2023, only 12% of in-person payments in the UK were made with cash, down from around 14% the year before. The shift away from cash isn’t slowing down either. Over the past five years or so, mobile wallets have become the norm, and that trend’s only picking up speed. The pandemic definitely played a part, with people wanting cleaner, contactless ways to pay. But even now, with COVID behind us, the days of cash ruling the till are well and truly over. And that’s a good thing – not just for customers, but for small businesses too.

Customers want fast, cashless convenience.

Whether they’re shopping online or in store, people expect speed and simplicity when they pay. No more fumbling for coins or waiting for change – just a tap of a card or a wave of a phone and they’re done. Tools like Apple Pay and Google Pay have made it normal to leave the house without a wallet. For many, the only thing they need is their phone, or even just a smartwatch.

Why this shift is a win for small businesses.

This move to digital payments doesn’t just meet customer expectations, it’s opening up real benefits for business owners, such as:

Customers spend more: When you’re not limited by the cash in your wallet, you’re more likely to spend a little extra.

Faster checkouts mean more sales: Contactless payments are processed almost instantly, so you can serve more customers, more quickly. And with less cash to count, daily wrap-ups are faster and there’s less need to head to the bank.

It’s safer too: No piles of cash in the till means less risk of theft or loss. On top of that, secure chips and tokenisation tech make digital payments tough to tamper with.

Open Banking and PSD2: driving change behind the scenes.

Regulation has played a big role in shaping the UK fintech space. Open Banking and PSD2 (the Revised Payment Services Directive) have made it easier for people to share financial data securely with trusted third parties, which has fuelled innovation and given smaller players a fair chance.

For small businesses, this has translated into more personalised financial tools, faster loan approvals, and better visibility over their money. Integrating payments with accounting software, for example, helps keep the books tidy without needing to do it all manually.

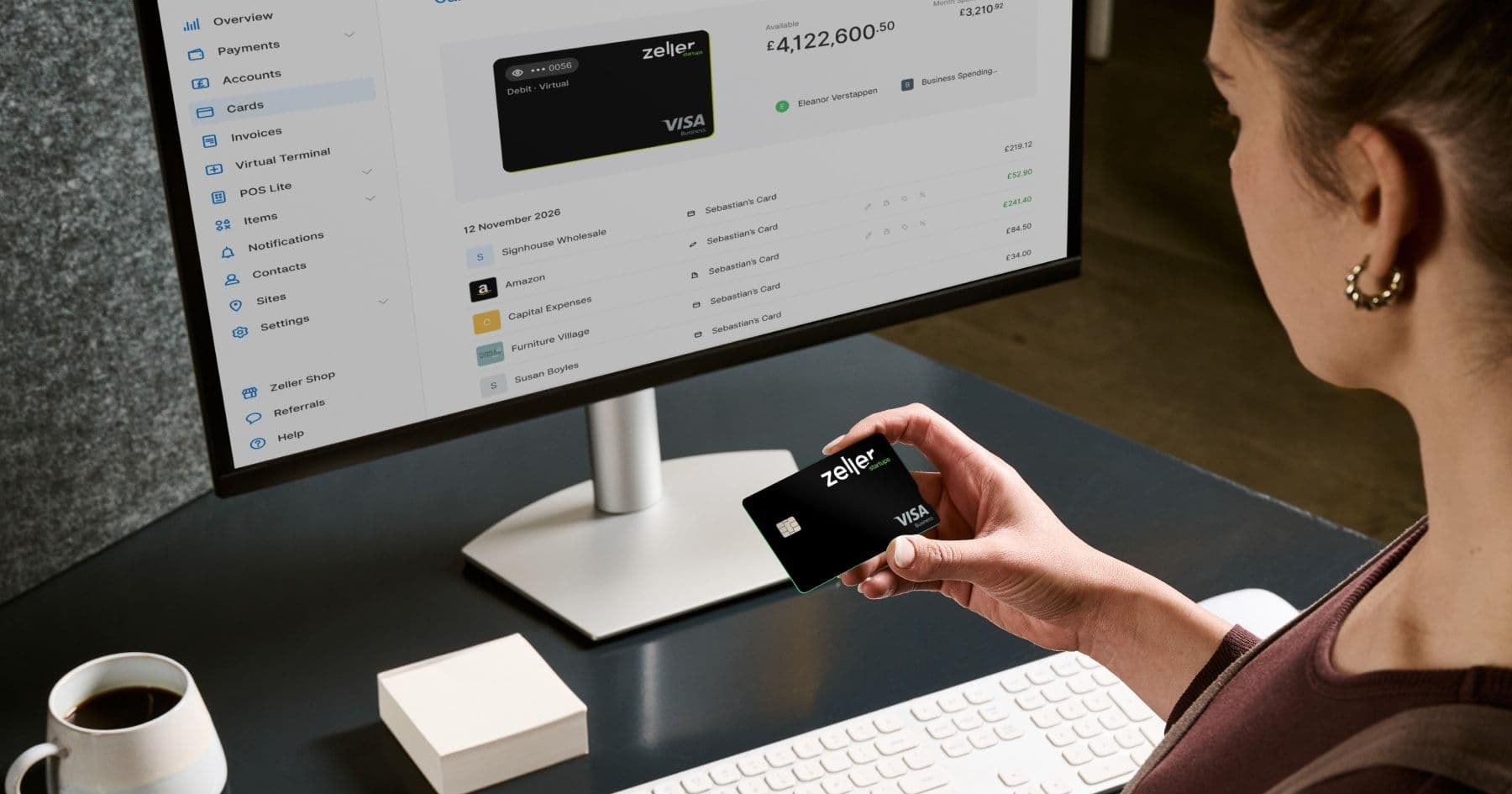

Neobanks and fintechs built for small businesses.

For years, traditional banks have underserved the needs of small businesses. High fees, slow processes, clunky tools…and the list goes on. But now, neobanks and fintechs with new services designed specifically for SMEs are changing the game.

These digital-first companies make it easy to open an account, send invoices, track expenses, and stay on top of your finances without the usual hassle. Everything’s faster, more flexible, and far more transparent, giving small business owners more control and confidence.

Real-time payments are closing cash flow gaps.

The Faster Payments Service is another key piece of the UK fintech puzzle. It allows money to move between UK banks in real time, 24/7. No waiting days for payments to clear – you get your money almost instantly. For small businesses, that means better cash flow, quicker payroll runs, smoother refunds, and fewer awkward conversations with suppliers.

Fintech lending is making funding more accessible.

Getting a traditional business loan has never been easy, with long applications, slow approvals, and loads of paperwork. Fintech lenders are making that whole process quicker and more flexible. With smarter systems and alternative ways to assess creditworthiness, they can offer finance options that actually work for smaller businesses. That means getting the money you need to grow or cover short-term gaps is (thankfully) no longer such a struggle.

What lies ahead for the UK’s fintech ecosystem?

Over the next few years, expect even more innovation. AI-driven financial tools, deeper integration between platforms, and tighter security are all on the horizon. Regulation will keep evolving too, aiming to strike the right balance between encouraging innovation and protecting users.

One trend worth watching is embedded finance, where financial services are baked into platforms you already use, like ecommerce tools or delivery apps. It’ll make managing money even more seamless and accessible.

All up, the UK fintech movement is making business life faster, safer, and easier. By making the most of these comparatively new tools, you’re not just keeping up, you’re setting yourself up to thrive.

Ready to get started with Zeller?

Zeller is coming to the UK soon, bringing award-winning payment solutions and tools designed to make managing your business finances simpler and more efficient. Join our waiting list today to be among the first to hear about our launch and exclusive offers.