Beyond the Tap: How Credit Card Machines Work.

Paying by card is second nature in the UK, and has been for some time. Whether it's buying a coffee or settling a salon bill, customers expect to tap and go wherever they go. But what happens beyond that quick little beep?

For small business owners, understanding the payment process helps explain where your money goes, why fees exist, and what role your card machine plays. With so many payment companies in the UK in addition to Zeller, like Square, SumUp and Worldpay, it might be a daunting task to evaluate what's the best solution to your business. A broad understanding of how card machines work can help make a decision. In this guide, we'll walk through a card payment journey and explain how modern tools like Zeller Terminal make it fast and reliable.

How do card machines process payments?

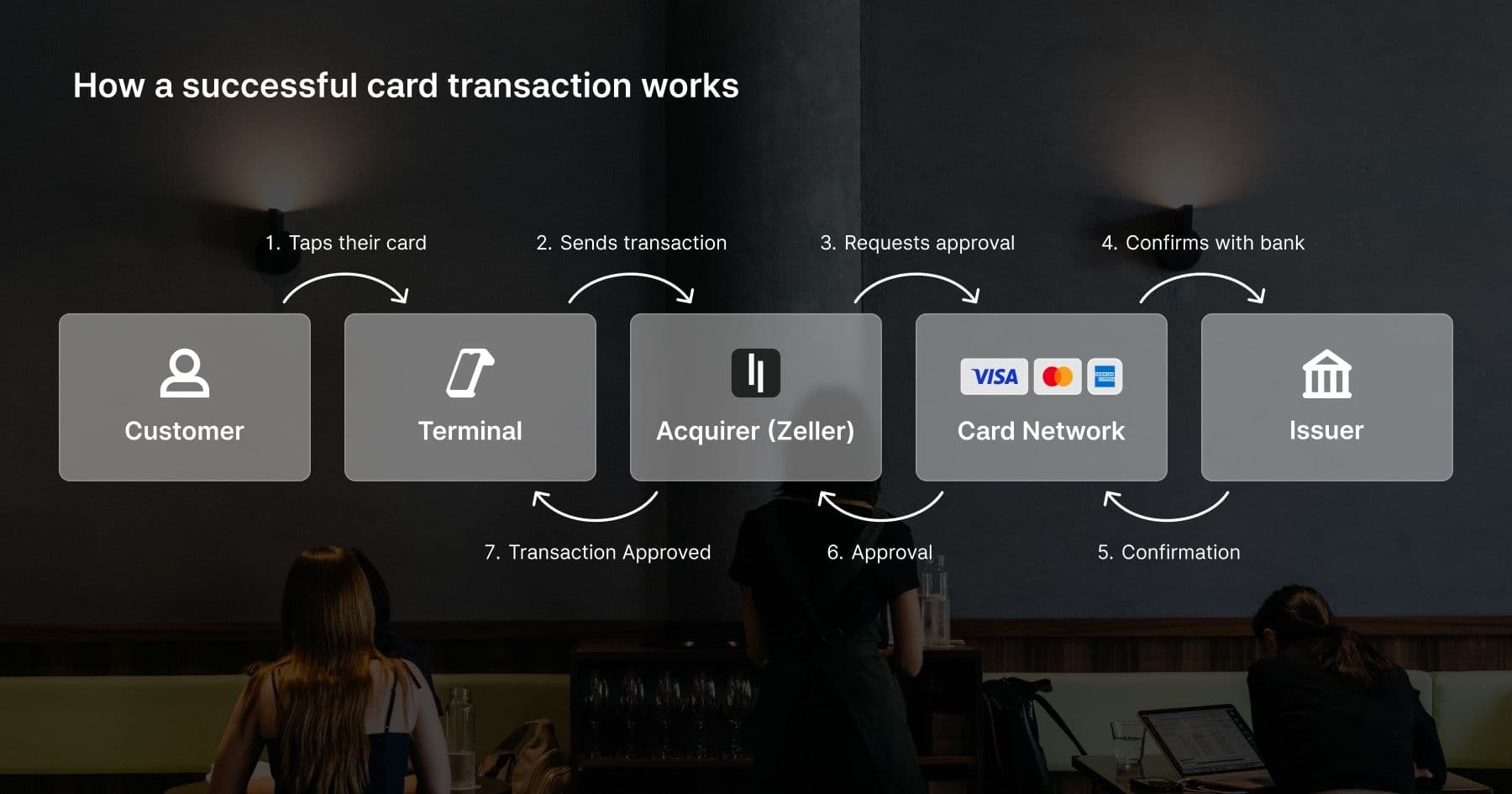

When a customer taps their card, your card machine instantly uses the infrastructure of the connected payment provider (e.g. Zeller) to send the transaction to the relevant card network (like Visa or Mastercard), which then contacts the customer’s bank. If everything checks out – the card is valid, funds are available, and there are no red flags – the bank approves the transaction and earmarks the money to be paid to you. All of this happens before your machine even flashes “Approved”.

This process is called authorisation, and it’s a real-time check that protects both you and your customer. Here’s a diagram of how it works:

Card payment processing: who's involved in the process?

While the tap feels instant, there’s a chain of entities ensuring every payment is handled securely, including:

Cardholder and issuing bank: The customer and their bank, which authorises the transaction.

Merchant: You, the business taking the payment.

Acquirer/payment provider: The company that processes payments for you.

Card machine provider: The company that produces and supplies your card machine.

Card network: Visa, Mastercard, etc., who transmit authorisation and settlement messages.

These days it’s par for the course for payment providers (including Zeller) to produce their own card machines, meaning you don’t have to juggle multiple parties. This streamlines your setup and helps ensure your payments are processed faster and more reliably.

Settlement: how the money gets to you.

Authorisation confirms the payment, but when does the money arrive? Well, that happens during settlement.

Each day, your completed transactions are grouped and sent for clearing. Here's how the funds move:

💳

The payment provider forwards transaction batches to card networks

🔢

The card networks calculate the amount due from each issuing bank.

🏦

Issuing banks transfer funds (minus interchange fees) to your provider

💷

Your provider deposits the amount into your merchant account.

This process can take 1-3 working days, but many providers offer faster payouts. Zeller Terminal settles payments nightly, so funds from today’s sales are well and truly in your account by the next morning. This is especially helpful for managing cash flow and planning ahead.

It’s worth noting that card networks and issuers also take fees (like interchange and assessment charges) as part of settlement.

Keeping payments secure.

Processing card payments means handling sensitive data. Fortunately, modern card machines and networks include robust protections, such as:

End-to-end encryption

Card data is encrypted from the moment it's captured, preventing it being intercepted or stolen.

EMV chip technology

Chips generate unique, one-time codes for each transaction, reducing potential for fraud.

PCI DSS compliance

Zeller Terminal is PCI Level 1 compliant – the highest level available.

Fraud detection systems

Banks and networks monitor for suspicious activity and intervene automatically.

Zeller's systems handle the hard part of compliance for you.

What Type of Card Machine Do I Need?

When you’re weighing up your options, it helps to understand the three main types of card machines available in the UK:

Countertop card machines

These sit at a fixed till point and connect via broadband or a phone line. They can be a solid option for businesses where payments are always taken at the counter, but are hard (or sometimes impossible) to move if for any reason you need to take payments in another area of the business.

Portable card machines

Portable machines connect to your Wi-Fi or Bluetooth network and can be carried around your premises. They’re commonly used in restaurants, pubs, and cafés, where staff need to take payments at the table.

Mobile card machines

These use a built-in SIM card to process payments wherever you are. They’re best for market stalls, taxis, delivery services, and tradespeople who need to accept payments on the move.

Understanding the different ways to pay.

UK customers use a mix of methods to pay, and your terminal needs to handle all of them:

Chip and PIN: Still standard for higher-value or older card payments.

Contactless cards: Most widely used for purchases under £100.

Mobile wallets: Apple Pay and Google Pay offer tap-and-go with additional security layers.

Magstripe fallback: Still used in rare cases, particularly by tourists or for older cards.

Zeller Terminal supports all of these, without requiring any extra configuration. That means fewer barriers for your customers and fewer missed sales for you.

Speed, reliability and support.

When your queue is growing and the pressure is on, a slow card machine can cost you business. Zeller Terminal is built to prevent those headaches with:

Dual connectivity: Wi-Fi and 4G for uninterrupted uptime.

Long battery life: Up to 10+ hours of use on a single charge.

Fast processor: Designed to handle back-to-back transactions without delay.

24/7 support: Zeller’s support team is on call whenever you need.

The Zeller ecosystem also includes a secure online dashboard where you can view transaction data, filter by amount or date, and download receipts and reports with a tap. This makes it easy to respond to things like chargebacks and also comes in very handy for business planning and at tax time.

Choosing the best card machine for your business.

When selecting a card machine, there are key features to consider beyond just the price tag, such as:

Accepted payment methods: Does it handle all major cards, contactless, and mobile wallets?

Ease of use: Is the device straightforward for your staff to learn and operate?

Connectivity: Can it function without Wi-Fi? Will it keep going through network dropouts?

Hardware ownership: Do you own the terminal outright or are you locked into a contract?

Software integration: Does it link with your POS or accounting system?

Transparent fees: Are processing fees fixed, and are there any hidden charges?

Support and training: Is help available when you need it?

Understanding card machine costs.

When researching card machines, you’ll typically find costs broken into three areas:

Hardware Costs – either a one-off purchase price for the machine or an ongoing rental fee.

Monthly Service Fees – some providers charge a subscription or account-keeping fee.

Transaction Fees – a percentage or flat fee charged on every card payment you accept.

One of the most important factors when deciding the best card reader for your small business is understanding the fee structure. Many traditional providers in the UK use a model called Interchange++.

What is Interchange++?

Interchange++ is a pricing model used by many traditional card payment providers in the UK. It separates transaction costs into three distinct components:

Interchange fees – set by card issuers, vary based on card type and transaction details.

Scheme fees (‘+’) – charged by card networks such as Visa and Mastercard.

Acquirer fees (‘+’) – added by your payment processor for handling the transaction.

While Interchange++ offers transparency by showing exactly where fees go, its complexity can make predicting monthly costs difficult, especially for small businesses with fluctuating transaction volumes.

Join the waitlist today.

Soon, UK businesses will be able to get their hands on one of our award-winning Zeller Terminals.